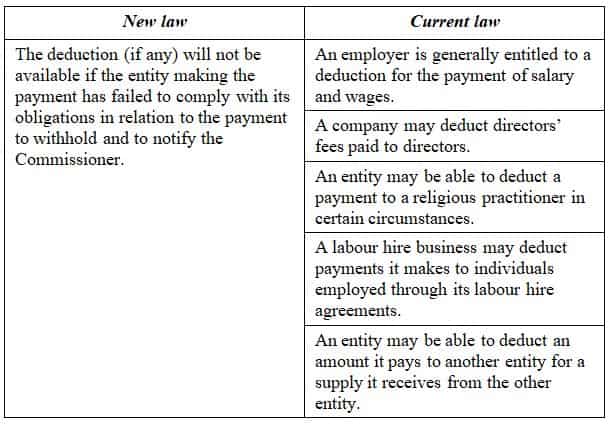

Arising from recommendations of the Black Economy Taskforce, the government is introducing measures that deny tax deductions for payments which are wages etc on which the withholding tax obligations have not been complied with.

The payments being targeted include employee wages & salaries (etc), directors’ fees, payments to religious practitioner, payments under a labour hire arrangement or for services where the payee has not quoted an ABN.

The measures commence 1 July 2019.

Eligible circumstances

The tax deduction is only denied where

- no amount has been withheld at all; or

- no notification is made to the Commissioner

Withholding or notifying the Commissioner of an incorrect amount will not trigger the loss of a tax deduction.

Proposed exceptions

- An exception is provided where an employer “honestly believes their employees are acting as contractors” and an ABN has been provided, even if the Tax Office doesn’t agree with the employer’s position.

- A deduction that would otherwise be denied is restored if the taxpayer voluntarily notifies the Commissioner of their mistake before the commencement of audit or other compliance activity.

Legislation for the measures has been approved by the Federal parliament. See Treasury Laws Amendment (Black Economy Taskforce Measures No. 2) Bill 2018

Further information

- Removing tax deductibility of non-compliant payments

- Treasury draft legislation and explanatory material

- Minister’s media release

This page was last modified 2018-12-04