Fuel Tax Credits

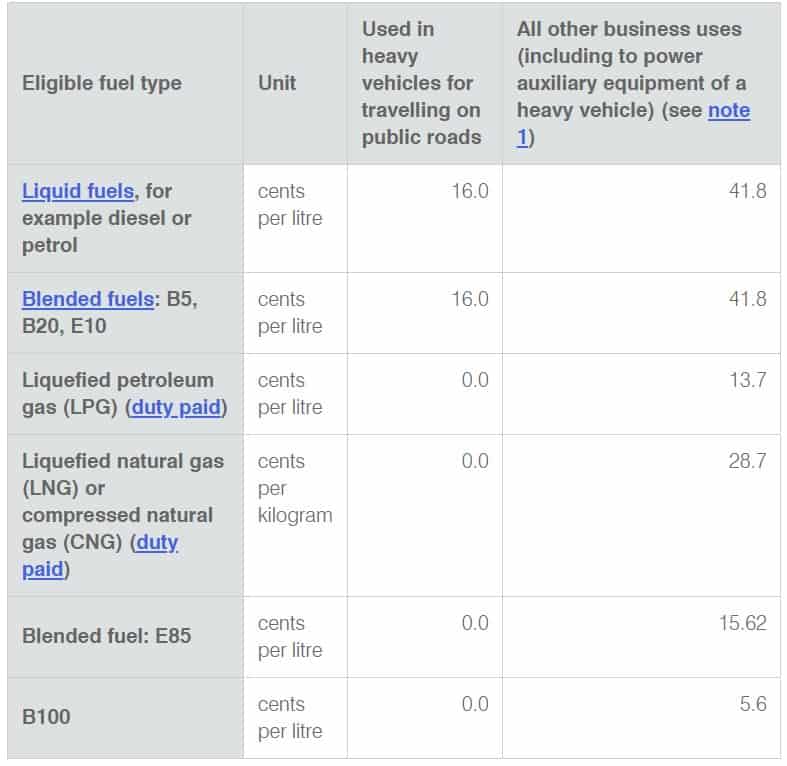

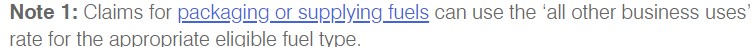

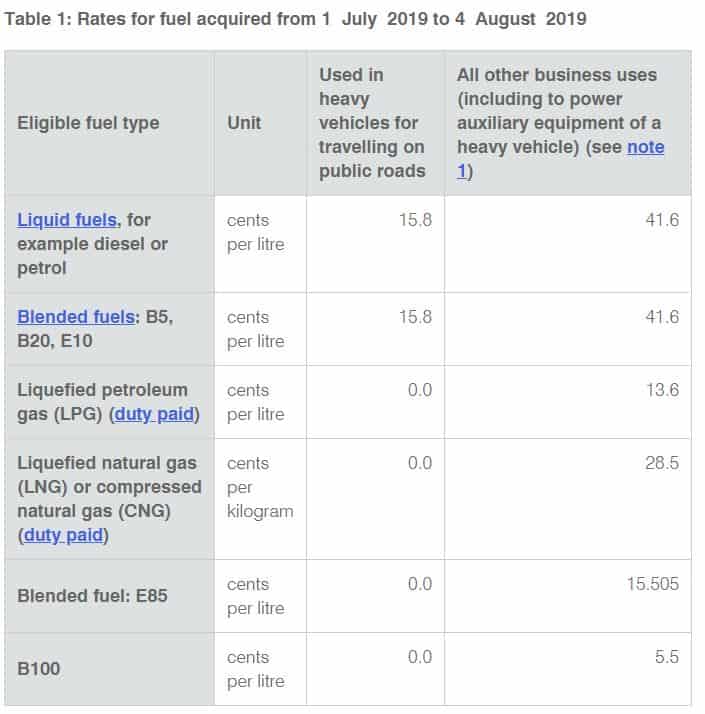

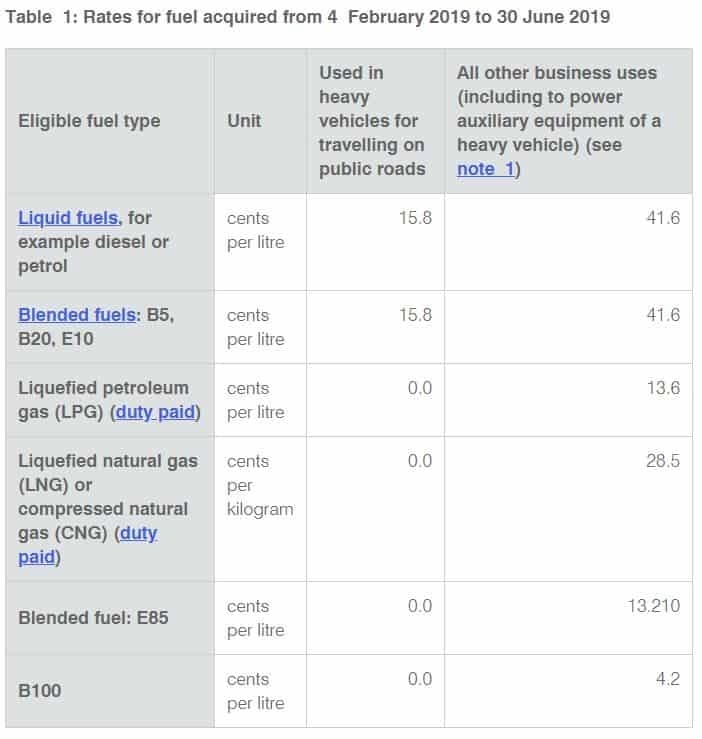

The fuel tax credit is a calculation of: (No. of eligible litres) x (cents-per-litre rate).

The cents-per-litre rate is generally the rate applicable on the date of purchase, however there are a number of exceptions which allow simplified calculations.

They include:

- Heavy vehicles used mainly off public roads – apportionment is not required for listed vehicle types

- Fuel used to power auxiliary equipment – listed fuel use percentages for equipment types can be used

Following court decisions the ATO has clarified the basis of claims for fuel used in heavy vehicles travelling on public roads.

Farmers in disaster affected areas:

The Tax Office has released Practical Compliance Guideline PCG 2019/2 which elaborates on the compliance relief available to farmers whose activity statement lodgment and payment deferrals have been granted due to a natural disaster.

Simplified Fuel Tax Calculations

Since BAS period ending on 31 March 2016 businesses claiming less than $10,000 credits annually can

- use the BAS period-end rate if the rate has changed during the period, and

- calculate litre usage based on the cost of the fuel purchased

See full details of simplified methodologies here.

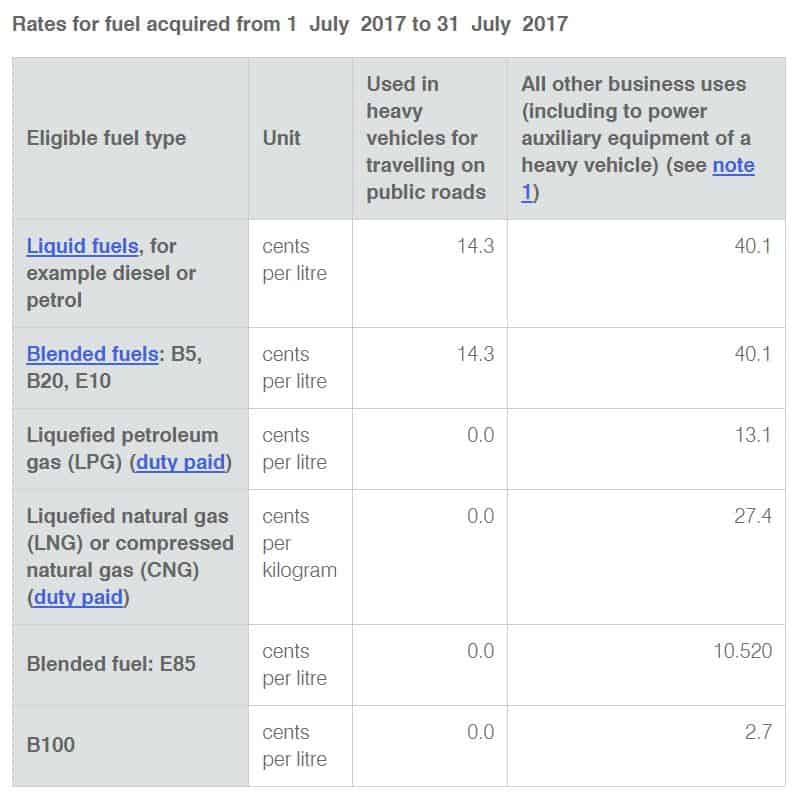

Credit rate

The cents-per-litre rate depends on

- fuel type

- eligible activity

Usage across differing activities must be separately identified.

For detailed instructions on how to claim fuel tax credits in a Business Activity BAS statement go here.

Tax Office Warning on Faulty Software

The Tax Office has issued an alert, warning of penalties for incorrect fuel tax credit claims generated by the use of faulty software products.

Incorrect claims can arise, for example, from relying on inaccurate assumptions, outdated maps or inadequate data sampling.

Taxpayers, their advisors and anyone marketing the offending products are in the Tax Office’s sights.

The warning has been issued as Taxpayer Alert TA 2021/3.

Current Fuel Tax Credit Rates

From 1 July 2023 to 30 June 2024

Updated tables for period from 1 July 2023

From 1 July 2022 to 30 June 2023

Updated tables for period from 1 July 2022

Budget 2022 measure: Temporary rate reduction

Fuel excise is temporarily halved for a period of 6 months from 30 March 2022 to 28 September 2022. Fuel tax credits claimed for this period use the lower rates.

Fuel used in heavy vehicles for travelling on public roads won’t have fuel tax credits for this period because the road user charge exceeds the excise duty paid, reducing the fuel tax credit rate to nil.

The ATO’s fuel tax credit calculator can be used to ensure the correct rates are claimed.

Rates for fuel acquired from 1 July 2021 to 30 June 2022

Updated tables for periods 1 July 2021 to 30 June 2022.

Rates for fuel acquired from 1 July 2020 to 30 June 2021

The updated tables of rates from 1 July 2020 to 30 June 2021 are here.

[Update 1 November 2019]

From 1 November 2019 fuel tax credits for fuel used to power passenger air conditioning units (for example in commercial buses and coaches) must be claimed at the rate for ‘heavy vehicles for travelling on public roads’. This rate is reduced by the Road User Charge.

[Update 5 August 2019]

Rates for fuel acquired from 5 August 2019 to 2 February 2020

[Update 1 July 2019]

For further detailed information see: All rates

[Update 4 Feb 2019]

[Update 1 Aug 2018]

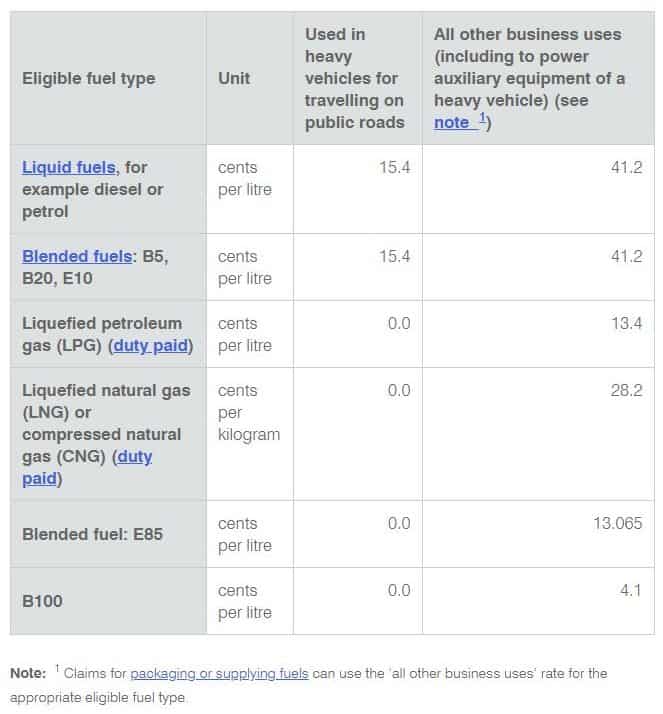

Rates for fuel acquired from 1 Aug 2018 to 3 Feb 2019

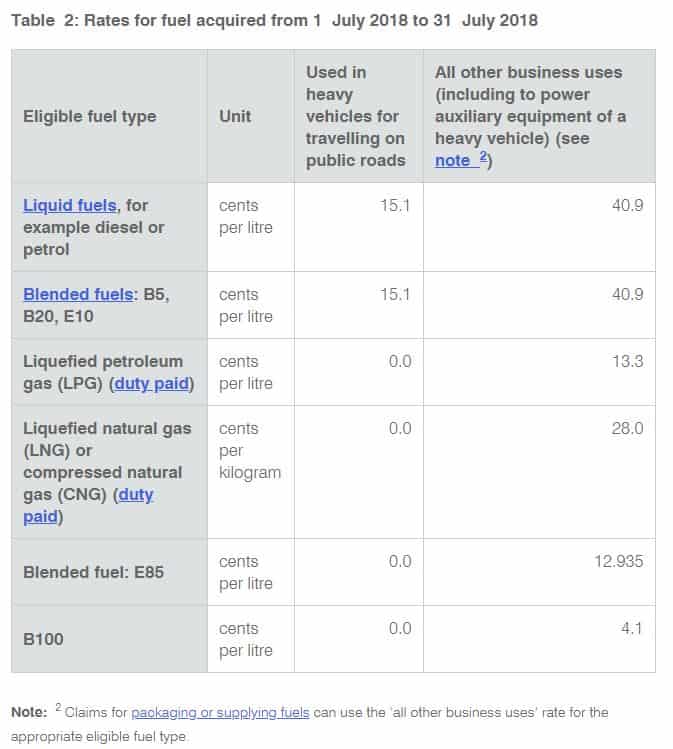

[Update 1 July 2018]

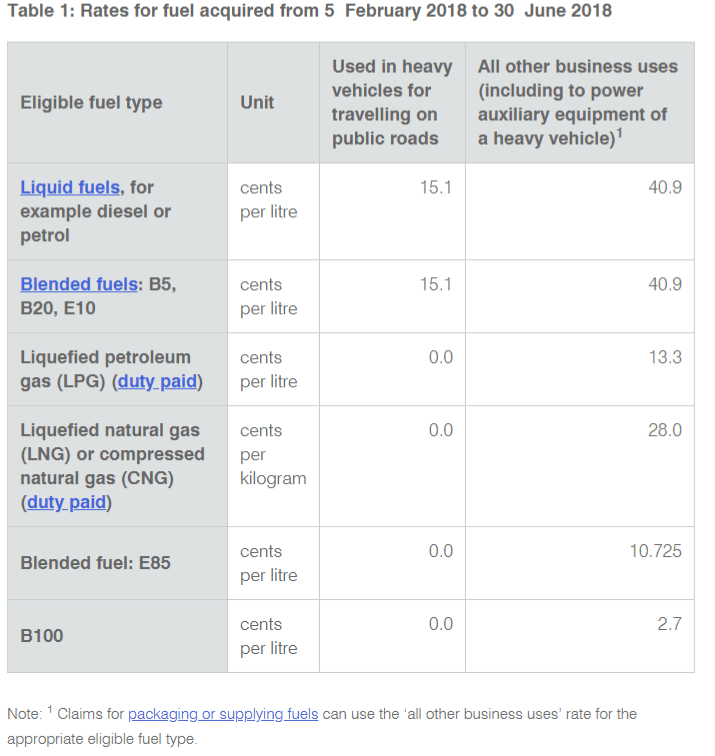

[Update 5 Feb 2018]

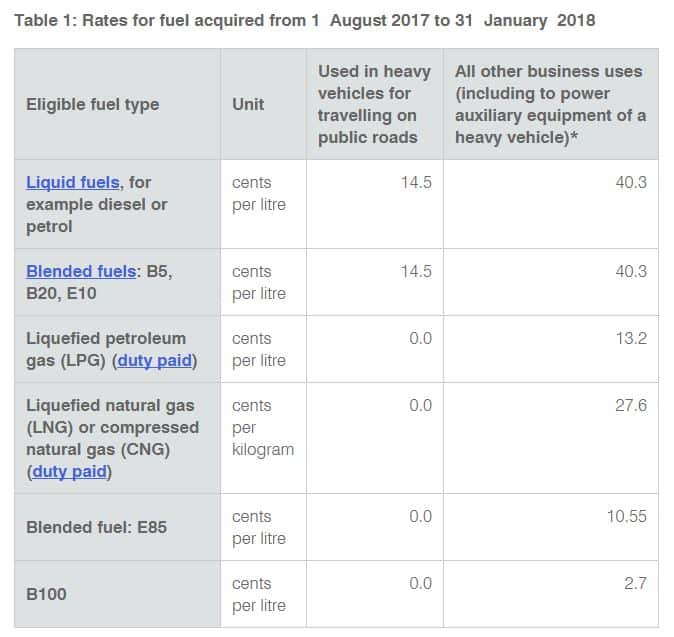

[Update 1 Aug 2017] Fuel Tax Credits Rates applicable from 1 August 2017 to 4 Feb 2018

[Update 1 July 2017] Fuel Tax Credits Rates applicable from 1 July 2017

Historical Fuel Tax Credit Rates

A full listing is at ato.gov.au.

[Update 1 February 2017] In line with the 6-monthly inflation adjustments (February and August), fuel tax credit rates for heavy vehicles on public roads have increased to 14.2 cents per litre, along with changes to a number of other rates from 1 February 2017.

[Update 1 August 2016] In line with the 6-monthly inflation adjustments (February and August), fuel tax credit rates for heavy vehicles on public roads have increased to 13.7 cents per litre, along with changes to a number of other rates from 1 August 2016.

[Update 1 July 2016] Fuel tax credit rates for heavy vehicles using diesel or petrol on public roads have increased to 13.6 cents per litre, and rates for bio fuels have changed.

[Update March 2016] From March 2016 businesses with under $10,000 of credits annually can use simplified BAS calculation methods. When there is a rate change, the BAS period end rate can be used, along with an average fuel price for the period. See more on this here.

The Tax Office has also published information on heavy vehicles (for example a tractor or backhoe) which may be treated as all business use, even if sometimes driven on a public road.

Fuel tax credit changes from 2014-15 and 2015-16 rates

From 1 July 2014, the carbon charge was removed from fuel tax credits. Rates were subsequently increased on 10 November 2014, and as a result of the introduction of 6-monthly indexation, changed again on 2 February 2015 and on subsequent indexation dates.

Fuel tax increase and introduction of indexation

Fuel excise was increased on 10 November 2014 as a result of tariffs which increased the fuel excise by 0.457 cents per litre for liquid fuels on top of the then existing 38.143 cents per litre, and also provide for biannual indexation to the consumer price index from 1 February 2015.

To have permanent effect these increases were made subject to further legislation which has since passed.

See also: Offsetting business costs associated with the increase in fuel excise.

A consequence of these measures is that monthly, quarterly or annual BAS returns data in 2014-15 will need to be organised to separately identify fuel purchases before and after the indexation date, in order to reflect the correct fuel tax credit claim.

The purpose of the fuel credit schemes is to reduce the cost of some fuels or to encourage waste oil recycling. Credits are for the fuel tax (excise or customs duty) included in fuel used in the business activities of:

- machinery

- plant

- equipment

- heavy vehicles

A fuel tax credit may also be available in respect to the cost of compressed natural gas (CNG) which has been carbon price adjusted and used in certain agriculture, fishing or forestry.

Ineligible:

Fuels which don’t qualify for the fuel tax credit are

- aviation fuels

- fuels used in light vehicles of 4.5 tonne gross vehicle mass or less travelling on a public road

- fuel not used use because it was lost, stolen or otherwise disposed of

- some alternative fuels

How to Register For Fuel Tax Credits

Registration for both GST and fuel tax credits is required before fuel tax credits can be claimed. If already registered for GST, the registration for fuel tax credits can be added by an authorised contact person.

For fresh business applications an ABN, GST and fuel tax credit registrations can all be applied for together.

Forms and contact details for registration are available from the Tax Office here.

Fuel tax credits are claimed in the business activity statement (BAS).

Omitted fuel tax credits – a choice

Recovering a tax credit claim which has been missed from an already-lodged BAS return can be made by including the claim in a future return, or by lodging an amended prior period return. See ATO ID 2014/4

Heavy Vehicles – road user charges – apportioning taxable fuel

A heavy vehicle fuel tax credit is reduced by the amount of the road user charge to the extent that the fuel is used for travel on a public road. This requires an apportionment of fuel use.

For guidance, see:

- Basic method for heavy vehicles – an easier way to determine (higher credit) off public road use.

- PCG 2021/2 Fuel tax credits – basic method for heavy vehicles

- Fuel tax credits – apportioning taxable fuel used in a heavy vehicle with auxiliary equipment – PCG 2016/11 (under review)

- FTD 2016/1 – Fuel used for idling and cabin air-conditioning of a vehicle on a public road

Fuel Tax Credits Eligibility Flow Chart

Source: ato.gov.au

- MT 2024/D1 Miscellaneous tax: time limits for claiming an input tax or fuel tax credit

- PCG 2021/2 Fuel tax credits – basic method for heavy vehicles

- Fuel Tax Credit Calculator & Tools

- ATO – Fuel Schemes

- Fuel tax credits calculation worksheet – ATO

- FTD 2019/1 Vehicles and satisfying environmental criteria

- FTD 2010/1 Fair and reasonable apportionment to calculate fuel tax credit entitlement.

- PCG 2016/2 Fuel tax credits — practical compliance methods for small claimants

- PCG 2016/3 Fuel tax credits — fuel tax credit rate for non business claimants

- PCG 2016/4 Fuel tax credits — incidental travel on public roads by certain vehicles.

- FTD 2016/1 – Fuel used for idling and cabin air-conditioning of a vehicle on a public road

- FTR 2008/1 Fuel tax: vehicle’s travel on a public road that is incidental to the vehicle’s main use and the road user charge

- Decision impact statement Linfox Australia Pty Ltd v Commissioner of Taxation

- PCG 2016/11 Fuel tax credits – apportioning taxable fuel used in a heavy vehicle with auxiliary equipment

- Fuel Blends

- Fuel Tax (Fuel Blends) Determination 2016 (No. 1)

This page was last modified 2023-07-28