The super guarantee percentage rate payable by employers from 1 July 2023 is 11%.

This moves to 11.5% from 1 July 2024.

The SG rate from 1 July 2022 for the 2022-23 year is 10.5% of eligible wages or salary.

From 1 July 2026, employee super payments will be required to be paid at the same time as their salary and wages (rather than quarterly). See media release: Introducing payday super.

Superannuation Guarantee Rates

| Until 30 June 2021 | 9.5% |

| From 1 July 2021 | 10% |

| From 1 July 2022 | 10.5% |

| From 1 July 2023 | 11% |

| From 1 July 2024 | 11.5% |

| From 1 July 2025 | 12% |

Rates for all years are listed below

When SG Rates Apply

The applicable rate of super payable is the rate in force on the day of wages payment.

For example, wages paid in the period from 1 July 2021 to 30 June 2022 will accrue a superannuation guarantee payment at the rate of 10%, notwithstanding that the work may have been performed in June 2021 or earlier.

The superannuation guarantee is a form of compulsory superannuation for the benefit of employees, with contributions required to be made by employers as a percentage of (not deducted from) the ordinary time earnings of employees and certain contractors.

The Superannuation Guarantee Adminstration Act is administered by the Australian Tax Office, which monitors compliance by employers. The ATO also helps employees find their “lost superannuation” contributions, unclaimed super, and can assist employees wanting to transfer their super from one account to another.

Recent Super Guarantee Amendments

Payday super: From 1 July 2026, employee super payments will be required to be paid at the same time as salary and wages. See Ministerial announcement.

The measure is currently awaiting legislation.

This will bring forward the timing of super payments, compared to the present position, where most employers typically pay quarterly in arrears.

The measure is intended to make it easier to track super payments and reduce losses associated with disreputable employers

[From 1 November 2021] New Choice Rules: New choice of super fund rules came into effect for new employees. The mandatory default super fund is to be the employee’s “stapled” fund.

Superannuation funds will be “stapled” to employee on change of employers.

There is administrative leniency for non-compliance for one year until 1 November 2022.

See further: Choice Rules

[From 1 November 2021] New Choice Rules: New choice of super fund rules came into effect for new employees. The mandatory default super fund is to be the employee’s “stapled” fund.

Superannuation funds will be “stapled” to employee on change of employers.

There is administrative leniency for non-compliance for one year until 1 November 2022.

See further: Choice Rules

$450 minimum removed

Legislation has been passed to remove the minimum $450 per month wages requirement for super guarantee eligibility.

This applies from 1 July 2022.

The Superannuation Guarantee will be extended to apply to an employee whose salary or wages are less than $450 per month.

[Update 3 June 2020: Covid-19] JobKeeper payments are excluded from the super guarantee with effect from 30 March 2020 (i.e. the commencement of the Jobkeeper scheme).

A regulation made under the Coronavirus Economic Response Package (Payments and Benefits) Rules 2020 excludes amounts paid to employees that do not relate to the performance of work and which are only paid meet the JobKeeper requirements.

Super Guarantee For Work Overseas

Work done outside Australia by non-residents is excluded from the super guarantee earnings base. (ATO ID 2015/24).

Employers of senior executives or specialists in Australia on certain temporary work visas have relief from the super guarantee under the regulations.

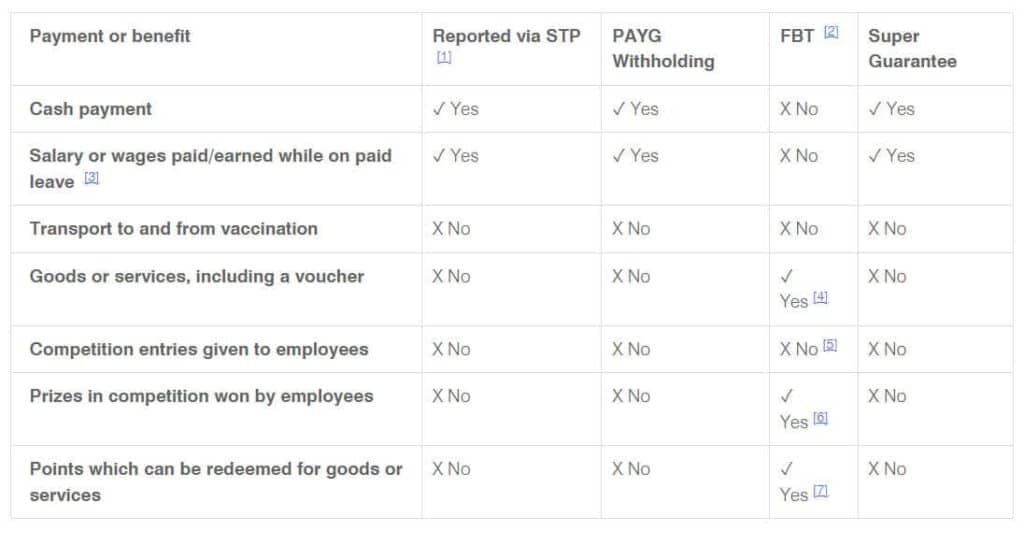

Covid Vaccinations Incentives and Rewards

Amnesty for employers from 24 May 2018 to 7 September 2020

This measure provides an opportunity for employers to catch up past super guarantee contributions without penalties and charges that may otherwise apply to late payments, provided they are not already under audit, in which case additional penalties apply (i.e. in addition to nominal interest).

The amnesty applies to unpaid contributions in any quarters from 1 July 1992 to 31 March 2018. (Quarters commencing 1 April 2018 are ineligible).

The amnesty came into effect on 6 March 2020 and gives employers from 24 May 2018 until 11:59pm (Eastern) on 7 September 2020 to disclose, lodge and pay.

The Tax Office has flagged a strict approach where an employer could have come forward voluntarily to disclose an SG shortfall and failed to do so, with a minimum (after remission) non-disclosure penalty of 100% of the SGC. The automatic penalty is 200%.

For remission of penalty policy, see PS LA 2020/D1 Remission of additional superannuation guarantee charge – since finalised and replaced with PS LA 2021/3 Remission of additional superannuation guarantee charge (issued 25 November 2021) which reflects the current policy.

Catch-up payments made in the amnesty period between 24 May 2018 and 7 September 2020 are tax-deductible; payments made at other times are not.

For a summary of the amnesty incentives see article Superannuation guarantee amnesty – ATO supporting employers affected by COVID-19 [8 April 2020]

Links and further info:

- ATO

- Legislation: Treasury Laws Amendment (Recovering Unpaid Superannuation) Bill 2019

- Article: Superannuation guarantee amnesty introduced … again!

- Minister’s statement

Employers Jail Time For Not Remitting SG Payments

Legislation has been passed which enables the Tax Commissioner to issue a direction to an employer to pay an outstanding superannuation guarantee liability or an estimate of the liability.

If the mentioned super guarantee amount is not paid within the period specified in the direction, there is a maximum penalty of 50 penalty units, or 12 months jail or both.

The legislation allows a direction to be given to employers to undertake super guarantee education.

See: Treasury Laws Amendment (2018 Measures No. 4) Bill 2018

Superannuation Guarantee Key ATO references:

The compulsory Superannuation Guarantee contributions are required to be made as a specified percentage of an employee’s Ordinary Time Earnings before tax.

Compulsory Super Guarantee percentage rate is being progressively increased to reach a target of 12% by the year 2025-26

Super Guarantee Percentage Rates Full List

These tables reflect the final position after the initial Federal Budget 2014 rate-increase proposals were re-phased, and as set out in the MRRT Repeal Measures Bill.

Super Guarantee From 1 July 2021 to 30 June 2026 and later

| For The Year ending on: | Rate |

| 30 June 2022 | 10.0% |

| 30 June 2023 | 10.5% |

| 30 June 2024 | 11.0% |

| 30 June 2025 | 11.5% |

| 30 June 2026 and later | 12.0% |

Super Guarantee From 1 July 2014 to 30 June 2021

| For The Year ending on: | Rate |

| 30 June 2015 | 9.5% |

| 30 June 2016 | 9.5% |

| 30 June 2017 | 9.5% |

| 30 June 2018 | 9.5% |

| 30 June 2019 | 9.5% |

| 30 June 2020 | 9.5% |

| 30 June 2021 | 9.5% |

Super Guarantee From 1 July 2002 to 30 June 2014

| Years | Rate |

| 1 July 2002 to 30 June 2013 | 9% |

| 1 July 2013 to 30 June 2014 | 9.25% |

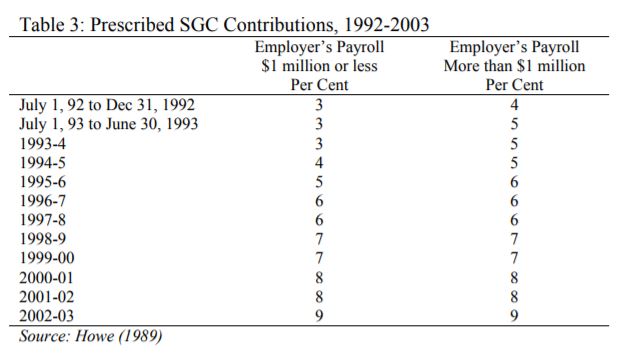

Super Guarantee From 1 July 1992 to 30 June 2003

The Superannuation Guarantee Scheme

The Definition of Ordinary Time Earnings (“OTE”)

As a generalisation, OTE is understood to refer to ordinarily recurring and unexceptional kinds of wage payments, and therefore doesn’t include (for example) ex gratia and redundancy payments or overtime.

From 1 January 2020 the meaning of OTE has been expanded to include amounts which would have been OTE had they not been salary-sacrificed by the employee into an eligible super fund. This measure designed stop the practice of employers counting salary sacrificed super towards their super guarantee obligations. (See Treasury Laws Amendment (2019 Tax Integrity and Other Measures No. 1) Bill 2019 and ATO summary).

It can be a difficult in practice deciding what is “ordinary” in various contexts, and what is not. Overtime earnings, for example, can form part of OTE.

The Tax Office’s current view is that “annual leave loading will be ordinary time earnings (OTE) unless it is referrable to a lost opportunity to work overtime”. This represents a change in previously accepted practice. See: Ruling SGR 2009/2 and commentary.

Super guarantee was considered not payable in respect of “additional hours” and “public holidays” salary components salaries because they are not “ordinary time earnings” in a May 2019 Federal Court decision reported here.

For some helpful commentary see “It Depends – Ordinary time earnings” – Cooper Grace Ward

Ordinary Time Earnings Checklist and Who Is An Employee

See checklist of payments classified as Ordinary Time Earnings.

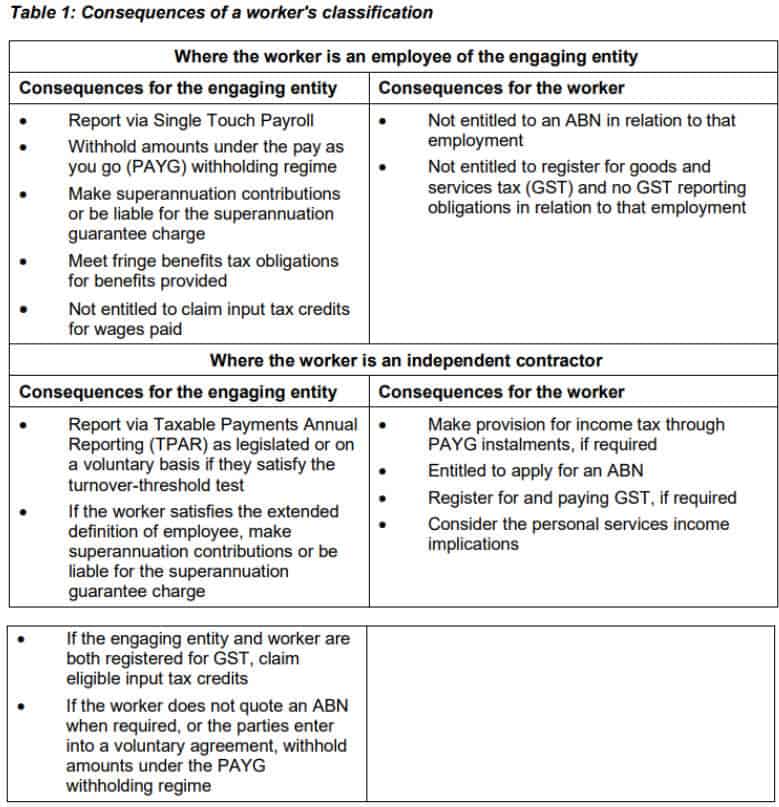

The Tax Office has issued guidance for the classification of employee vs contractor arrangements. See:

- * Superannuation Guarantee Ruling SGR 2005/1 Superannuation guarantee: who is an employee? (* Ruling currently under review)

- Practical Compliance Guideline PCG 2023/2 Classifying workers as employees or independent contractors – ATO compliance approach

- TR 2023/4 Income tax: pay as you go withholding – who is an employee?

- Explanatory article

ATO Ruling – Ordinary Time Earnings And Contractors

The expanded definition of ’employee’ for Superannuation Guarantee purposes includes contractors if the contract is “wholly or principally” for their labour.

The Tax Office has provided detailed guidance of their interpretations on this issue in ruling Superannuation Guarantee Ruling SGR 2005/1 (currently under review). See also: What Is An Employee?

Free Online Super Guarantee Eligibility Decision Tool

The ATO has an anonymous on-line Super Guarantee decision tool which can help you step through the issues in determining super guarantee obligations.

If you are forming your own opinion to exclude certain payments from your super guarantee obligations, professional advice is highly recommended.

Salary Packaging: Preventing The Superannuation Gap

An amendment to the super guarantee laws has been passed which prevents employers exploiting the relationship between salary packaging and the super guarantee requirements.

When a nominal salary is divided into salary plus voluntary super contributions, the law previously allowed employers to count the salary sacrificed super towards its super guarantee obligation calculated on the (reduced) salary component of the package.

Thus less superannuation was paid than might otherwise be the case, the shortfall having been identified as a “superannuation gap“.

This law took effect from 1 January 2020 and prevents salary-sacrificed superannuation contributions being counted as part of the employer’s superannuation guarantee obligation.

See ATO guidance: GN 2020/1 Salary sacrifice and super guarantee

For details of the legislation see Treasury Laws Amendment (2019 Tax Integrity and Other Measures No.1) Bill 2019

Super Guarantee Opt-out: Multiple Employers

Measures have been introduced to allow employees to opt out of Super Guarantee when their entitlement to receive super contributions from multiple employers would result in a breach their concessional contribution limit.

See Treasury Laws Amendment (2018 Superannuation Measures No. 1) Bill 2018

The Minimum and Maximum Wage Limits For Compulsory Contributions

From 1 July 2022 there is no minimum wage requirement for super guarantee to apply. See legislation.

Until 30 June 2022, a minimum threshold of gross wages of $450 per calendar month applied.

There is also a maximum level of earnings, over which the compulsory superannuation guarantee amount does not apply. The limit applies to Ordinary Time Earnings (OTE).

The maximum is indexed to inflation on an annual basis in accordance with movements in AWOTE (Average Weekly Ordinary Time Earnings).

Maximum Ordinary Times Earnings (‘OTE’) For Super Guarantee By Year

| Financial Year | OTE Per Quarter | OTE Per Annum |

|---|---|---|

| 2024-25 | $65,070 | $260,280 |

| 2023–24 | $62,270 | $249,080 |

| 2022–23 | $60,220 | $240,880 |

| 2021–22 | $58,920 | $235,680 |

| 2020–21 | $57,090 | $228,360 |

| 2019–20 | $55,270 | $221,080 |

| 2018–19 | $54,030 | $216,120 |

| 2017–18 | $52,760 | $211,040 |

| 2016–17 | $51,620 | $206,480 |

| 2015–16 | $50,810 | $203,240 |

| 2014–15 | $49,430 | $197,720 |

| 2013–14 | $48,040 | $192,160 |

| 2012–13 | $45,750 | $183,000 |

| 2011–12 | $43,820 | $175,280 |

| 2010–11 | $42,220 | $168,880 |

| 2009–10 | $40,170 | $160,680 |

| 2008–09 | $38,180 | $152,720 |

| 2007–08 | $36,470 | $145,880 |

| 2006–07 | $35,240 | $140,960 |

| 2005–06 | $33,720 | $134,880 |

| 2004–05 | $32,180 | $128,720 |

| 2003–04 | $30,560 | $122,240 |

| 2002–03 | $29,220 | $116,880 |

| 2001–02 | $27,510 | $110,040 |

| 2000–01 | $26,300 | $105,200 |

| 1999–2000 | $25,240 | $100,960 |

| 1998–99 | $24,480 | $97,920 |

| 1997–98 | $23,630 | $94,520 |

| 1996–97 | $22,590 | $90,360 |

| 1995–96 | $21,720 | $86,880 |

| 1994–95 | $20,780 | $83,120 |

| 1993–94 | $20,160 | $80,640 |

| 1992–93 | $20,000 | $80,000 |

These thresholds are inflation-adjusted annually.

Contributions above these earnings base levels are voluntary. Note also that Superannuation Guarantee contributions count towards an individual’s concessional contributions cap.

The Super Guarantee Age Limits

Excluded:

- Under 18 part time employees, i.e. working less than 30 hrs per week. (Each week considered separately)

- Employees over age 70 until 30 June 2013

Included:

- From 1 July 2013 there is no upper age limit, bringing eligible employees over the age of 70 years back into the Super Guarantee net.

Time Limits On Payments of Super Guarantee Contributions: When Do The Contributions Need To Be Paid?

(Note: see amnesty period from 24 May 2018 to 7 September 2020 as above)

The ATO time limit for payment of Superannuation Guarantee contributions is 28 days after the end of each quarter. Some employment agreements or awards may provide a greater frequency.

Failure to make a contributions deadline, requires a Superannuation Charge statement to be lodged and paid within a further 28 days. The Superannuation Charge is non tax deductible and made up of:

- the required superannuation contributions (less any since paid)

- interest

- administration penalty

Policy for the application and remission of super guarantee charge penalties is set out in Practice Statement Law Administration document PS LA 2021/3 Remission of additional superannuation guarantee charge (issued 25 November 2021).

Payday Super From 1 July 2026

The Government has announced it will require superannuation guarantee contributions to be paid by employers at the same time as their employees’ salary and wages.

The measure is proposed to commence on 1 July 2026.

This will require Super Guarantee payments to be made at the same time as wages, and under the One Touch Payroll processing systems.

Employee’s Choice of Super Fund

Since 1 July 2005, eligible employees have had the right to choose the super fund for their compulsory superannuation guarantee contributions.

The criteria for determining employee eligibility can be reviewed here.

Choice requirements have been simplified by removing the obligation to offer a choice of fund to temporary resident employees, or when superannuation funds merge. The changes take effect from 1 July 2015.

An employer meets the choice requirements by giving the employee a Standard Choice Form (PDF download) and then acting on the employee’s election within 2 months.

If an employee fails to complete a choice nomination and provide the necessary information, the employer has to pay the superannuation guarantee contributions to a complying Employer Nominated Fund which must also (with some exceptions) offer a minimum level of life insurance cover.

An employer is only obliged to respond to one choice nomination within each year.

See also: How To Choose A Super Fund Like A Pro

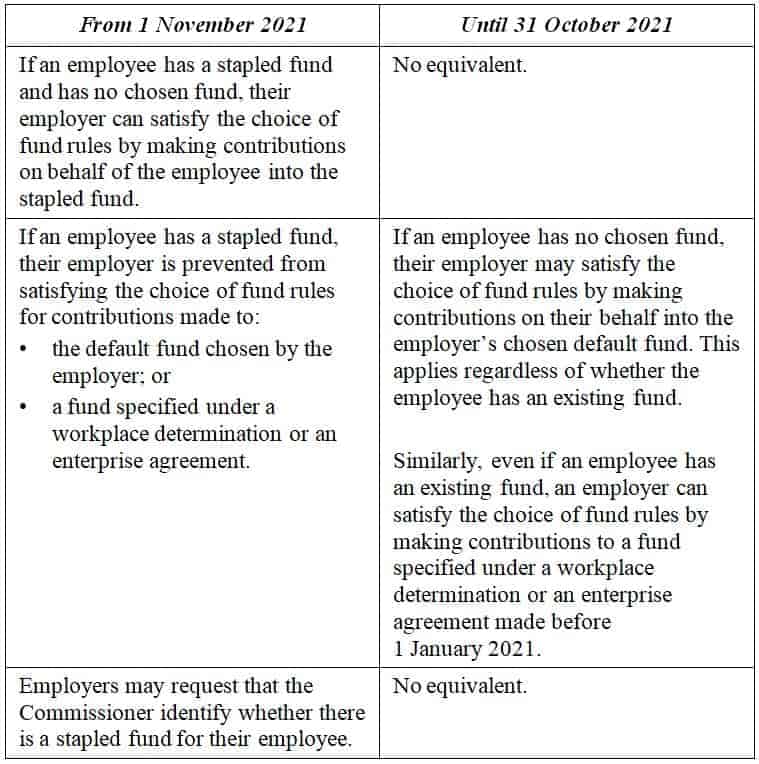

Choice expanded to workplace agreements from 1 January 2021

The super guarantee rules have been amended to provide that employees under workplace determinations or enterprise agreements made on or after 1 Jan 2021 have the right to choose their superannuation fund.

See Treasury Laws Amendment (Your Superannuation, Your Choice) Bill 2019 and media release

New Choice Rules From 1 November 2021 For New Employees Stapled Fund Becomes Default

Under legislation taking effect from 1 November 2021 (i.e. in respect of employees who are employed after that date), if an employee has not exercised a choice, the contributions must be made to the employee’s “stapled” fund, as confirmed by the Tax Office.

The measures apply to new employees from 1 November 2021. (The Bill in its original form specified a 1 July 2021 start date, but was changed by amendment to 1 November in order to align the measure with first annual performance test for MySuper products.)

Only if the Tax Office as confirmed that the employee does not have a stapled fund, can a super contribution be forwarded to an alternative default fund.

See a further explanation of the new rules here: TaxRambling.com

Compliance leniency until 1 November 2022

The Tax Office has published a transitional approach to compliance to apply in the period 1 November 2021 to 31 October 2022, during which time the choice shortfall penalty will be reduced to nil if the shortfall “arose due to the employer’s lack of knowledge of the stapled fund requirements rather than intentional disregard.”

From 1 November 2022 the “lack of knowledge” excuse is no longer available, and a choice shortfall penalty will apply according to a scale of responsibility ranging from “genuine effort” (0% choice shortfall penalty) to “knowingly decides not to comply” (100% choice shortfall penalty).

See in detail: SPR 2021/1.

The Commissioner has also published an approach to super guarantee shortfall for late contributions when an ATO-advised stapled fund has rejected contributions subsequently made to a fund after the due date. Guidelines and case considerations are outlined in SPR 2021/2.

Ordinary Time Earnings Checklist

See also explanations Ordinary Time Earnings

[Update 3 June 2020: Covid-19] By regulation JobKeeper payments were excluded from the super guarantee with effect from 30 March 2020 (i.e. the commencement of the Jobkeeper scheme).

| AWARDS AND AGREEMENTS | ||

| Payment | Salary or wages | Ordinary time earnings (OTE) |

| Overtime hours – award stipulates ordinary hours to be worked and employee works additional hours for which they are paid overtime rates | Yes | No |

| Overtime hours – agreement prevails over award | Yes | No |

| Agreement supplanting award removes distinction between ordinary hours and other hours | Yes – all hours worked | Yes – all hours worked |

| No ordinary hours of work stipulated | Yes – all hours worked | Yes – all hours worked |

| Casual employee: shift loadings | Yes | Yes |

| Casual employee: overtime payments | Yes | No |

| Casual employee whose hours are paid at overtime rates due to a 'bandwidth' clause | Yes | No |

| Piece-rates – no ordinary hours of work stipulated | Yes | Yes |

| Overtime component of earnings based on hourly-driving-rate method stipulated in award | Yes | No |

| ALLOWANCES | ||

| Payment | Salary or wages | Ordinary time earnings (OTE) |

| Allowance by way of unconditional extra payment | Yes | Yes |

| Expense allowance expected to be fully expended | No | No |

| Danger allowance | Yes | Yes |

| Retention allowance | Yes | Yes |

| Hourly on-call allowance in relation to ordinary hours of work for doctors | Yes | Yes |

| EXPENSES | ||

| Payment | Salary or wages | Ordinary time earnings (OTE) |

| Reimbursement | No | No |

| Petty cash | No | No |

| Reimbursement of travel costs | No | No |

| Payments for unfair dismissal | No | No |

| Workers' compensation: returned to work | Yes | Yes |

| Workers' compensation: not working | No | No |

| LEAVE | ||

| Payment | Salary or wages | Ordinary time earnings (OTE) |

| Annual leave | Yes | Yes |

| Annual leave loading - demonstrably referable to a loss of opportunity to work overtime | Yes | No |

| Annual leave loading - all other | Yes | Yes |

| Sick leave | Yes | Yes |

| Parental leave – eg maternity leave, paternity leave, adoption leave | No | No |

| Ancillary leave – eg jury duty, defence reserve service | No | No |

| TERMINATION PAYMENTS | ||

| Payment | Salary or wages | Ordinary time earnings (OTE) |

| Termination payments: in lieu of notice | Yes | Yes |

| Termination payments: unused annual leave, long service leave or sick leave | Yes | No |

| BONUSES | ||

| Payment | Salary or wages | Ordinary time earnings (OTE) |

| Performance bonus | Yes | Yes |

| Bonus labelled as ex-gratia but in respect of ordinary hours of work | Yes | Yes |

| Christmas bonus | Yes | Yes |

| Bonus in respect of overtime only | Yes | No |

Source: ato.gov.au

Small Business Superannuation Clearing House

This is a free government superannuation payments clearing service for small businesses with less than 20 employees.

This enables small businesses to make one payment to the clearing house, which then disburses the money to the required selection of superannuation fund accounts.

See: Small Business Clearing House.

Related Information

Super for long-distance drivers – ATO

This page was last modified 2023-12-06