HECS and HELP Student Loan Scheme Repayments

The student Higher Education Loan Program (HELP/HECS VETSL, TSL and Financial Supplement) repayments are added by the Tax Office to the tax payable on your tax return, based on your annual income.

The repayment rates are fixed for each year and are set out in the tables below.

Repayment Rates and Income Thresholds For The 2023-24 Year

HELP repayment rates and thresholds from 1 July 2023 for 2023-24

| Repayment income | Repayment rate |

| Below $51,550 | Nil |

| $51,550 to $59,518 | 1.00% |

| $59,519 – $63,089 | 2.00% |

| $63,090 – $66,875 | 2.50% |

| $66,876 – $70,888 | 3.00% |

| $70,889 to $75,140 | 3.50% |

| $75,141 to $79,649 | 4.00% |

| $79,650 – $84,429 | 4.50% |

| $84,430 – $89,494 | 5.00% |

| $89,945 – $94,865 | 5.50% |

| $94,866 – $100,557 | 6.00% |

| $100,558 – $106,590 | 6.50% |

| $106,591 – $112,985 | 7.00% |

| $112,986 – $119,764 | 7.50% |

| $119,765 – $126,950 | 8.00% |

| $126,951 – $134,568 | 8.50% |

| $134,569 – $142,642 | 9.00% |

| $142,643 – $151,200 | 9.50% |

| $151,201 and above | 10.00% |

Repayment Rates and Income Thresholds For The 2022-23 Year

HELP repayment rates and thresholds from 1 July 2022 for 2022-23

| Repayment income | Repayment rate |

| Below $48,361 | Nil |

| $48,361 to $55,836 | 1.00% |

| $55,837 to $59,186 | 2.00% |

| $59,187 to $62,738 | 2.50% |

| $62,739 to $66,502 | 3.00% |

| $66,503 to $70,492 | 3.50% |

| $70,493 to $74,722 | 4.00% |

| $74,723 to $79,206 | 4.50% |

| $79,207 to $83,958 | 5.00% |

| $83,959 to $88,996 | 5.50% |

| $88,997 to $94,336 | 6.00% |

| $94,337 to $99,996 | 6.50% |

| $99,997 to $105,996 | 7.00% |

| $105,997 to $112,355 | 7.50% |

| $112,356 to $119,097 | 8.00% |

| $119,098 to $126,243 | 8.50% |

| $126,244 to $133,818 | 9.00% |

| $133,819 to $141,847 | 9.50% |

| $141,848 and above | 10.00% |

Repayment Rates and Income Thresholds For The 2021-22 Year

HELP repayment rates and thresholds from 1 July 2021 for 2021-22

| Repayment income | Repayment rate |

| Below $47,014 | Nil |

| $47,014 to $54,281 | 1.00% |

| $54,282 to $57,538 | 2.00% |

| $57,539 to $60,991 | 2.50% |

| $60,992 to $64,650 | 3.00% |

| $64,651 to $68,529 | 3.50% |

| $68,530 to $72,641 | 4.00% |

| $72,642 to $77,000 | 4.50% |

| $77,001 to $81,620 | 5.00% |

| $81,621 to $86,518 | 5.50% |

| $86,519 to $91,709 | 6.00% |

| $91,710 to $97,212 | 6.50% |

| $97,213 to $103,044 | 7.00% |

| $103,045 to $109,226 | 7.50% |

| $109,227 to $115,678 | 8.00% |

| $115,679 to $122,728 | 8.50% |

| $122,729 to $130,091 | 9.00% |

| $130,092 to $137,897 | 9.50% |

| $137,898 and above | 10.00% |

Repayment Rates and Income Thresholds For The 2020-21 Year

| Repayment income | Repayment rate |

| Below $46,620 | Nil |

| $46,620 to $53,826 | 1.00% |

| $53,827 to $57,055 | 2.00% |

| $57,056 to $60,479 | 2.50% |

| $60,480 to $64,108 | 3.00% |

| $64,109 to $67,954 | 3.50% |

| $67,955 to $72,031 | 4.00% |

| $72,032 to $76,354 | 4.50% |

| $76,355 to $80,935 | 5.00% |

| $80,936 to $85,792 | 5.50% |

| $85,793 to $90,939 | 6.00% |

| $90,940 to $96,396 | 6.50% |

| $96,397 to $102,179 | 7.00% |

| $102,180 to $108,309 | 7.50% |

| $108,310 to $114,809* | 8.00% |

| $114,810* to $121,698 | 8.50% |

| $121,699 to $128,999 | 9.00% |

| $129,000 to $136,739 | 9.50% |

| $136,740 and above | 10.00% |

The minimum repayment threshold and income repayment bands are indexed annually based on year-on-year CPI measured quarterly up to the end of December of the preceding year. (Higher Education Support Act 2003 (Section 154-25))

Interest is not charged on loans (hence there is no “HECS interest rate” as such), however the amount of the debt is adjusted on 1 June each year in accordance with an annually determined inflation factor. The year-by-year indexation rates are set out in the “Debt Indexation” table below.

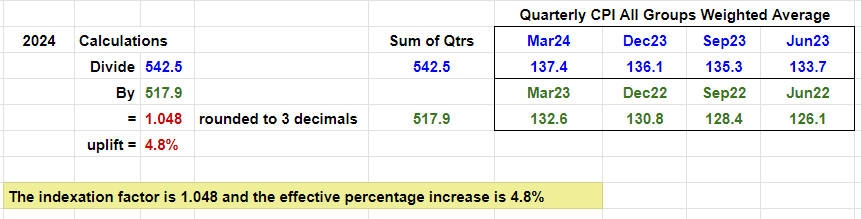

HECS/HELP Debts Indexation Factor for 2023-24

The annual indexation factor is updated in June of each year. The next update will be on 1 June 2024.

The indexation rate for 2024 is yet to be officially confirmed, but based on the existing formula, the rate will be 4.8%. The calculation for this is here.

The government has indicated an intention to provide relief in the upcoming May 2024 budget, which may have an impact on the final position.

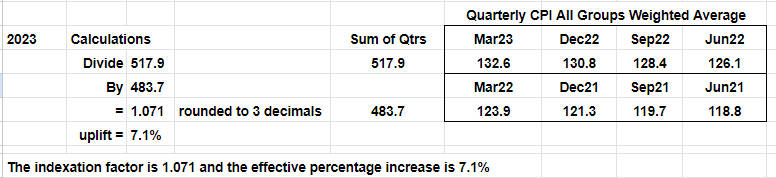

HECS/HELP Debts Indexation Factor for 2022-23 is 7.1%

The annual indexation factor is updated in June of each year. The next update will be on 1 June 2024.

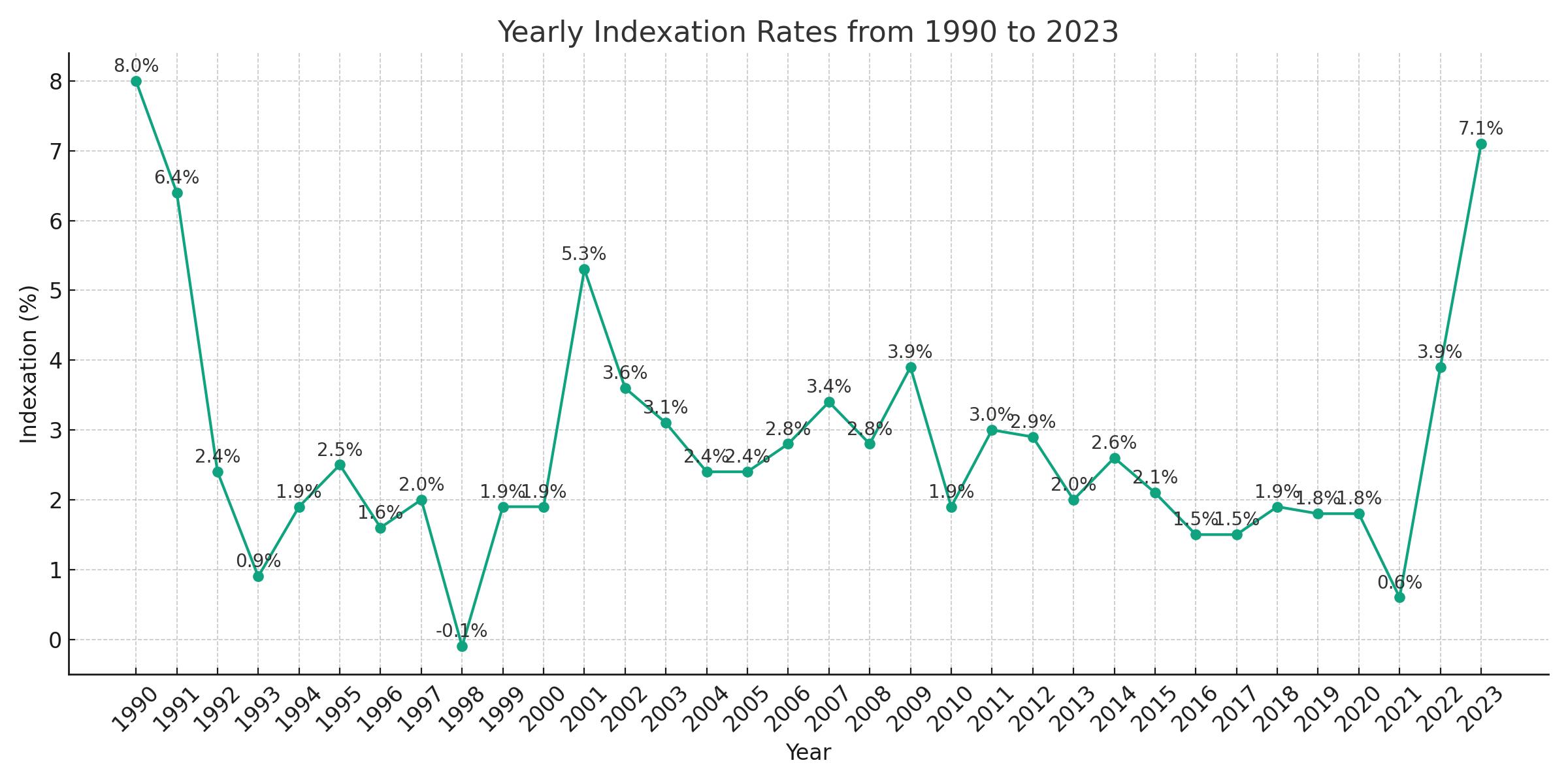

HELP Debt Indexation All Years

(click here to reveal)

| HECS – HELP Loans Annual Indexation | |

| Year ended 30 June.. | Percentage |

| 2024 (to be confirmed) | 4.8% |

| 2023 | 7.1% |

| 2022 | 3.9% |

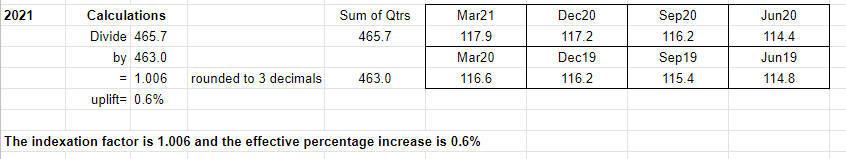

| 2021 | 0.6% |

| 2020 | 1.8% |

| 2019 | 1.8% |

| 2018 | 1.9% |

| 2017 | 1.5% |

| 2016 | 1.5% |

| 2015 | 2.1% |

| 2014 | 2.6% |

| 2013 | 2.0% |

| 2012 | 2.9% |

| 2011 | 3.0% |

| 2010 | 1.9% |

| 2009 | 3.9% |

| 2008 | 2.8% |

| 2007 | 3.4% |

| 2006 | 2.8% |

| 2005 | 2.4% |

| 2004 | 2.4% |

| 2003 | 3.1% |

| 2002 | 3.6% |

| 2001 | 5.3% |

| 2000 | 1.9% |

| 1999 | 1.9% |

| 1998 | -0.1% |

| 1997 | 2.0% |

| 1996 | 1.6% |

| 1995 | 2.5% |

| 1994 | 1.9% |

| 1993 | 0.9% |

| 1992 | 2.4% |

| 1991 | 6.4% |

| 1990 | 8.0% |

HECS/HELP Indexation History

Indexation of debts is linked to progress of the year-on-year CPI measured quarterly up to the end of March. This means that each year you can accurately anticipate the index factor as soon as March quarter CPI is published, usually by the end of April.

Indexation formula

Section 140-10 of the Higher Education Support Act 2003, requires the ‘indexation factor’ to be calculated by using the sum of the index numbers for the four quarters ending March for the current year, divided by the sum of the index numbers for the four quarters to March for the preceding year.

The ‘index number’ referred to is Specified in the Higher Education Support Act 2003 Schedule 1. It is the All Groups Consumer Price Index number (being the weighted average of the 8 capital cities) published by the Bureau of Statistics. The quarterly All Groups CPI updates are listed here.

On 1 June each year, the outstanding HELP debt balance (including debts added, repayments and any other adjustments) is multiplied by the indexation factor.

2024 HECS HELP Indexation Factor Calculation

The indexation rate for the 2024 year calculated according to the current (existing) formula is set out below, based on the released March 2024 quarterly CPI.

The government has indicated that there may be some assistance in the May 2024 budget.

2023 HECS HELP Indexation Factor Calculation

The indexation rate for the 2023 year is 7.1%, calculated according to the formula as follows:

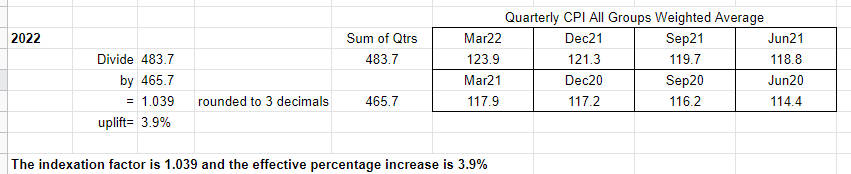

2022 HECS HELP Indexation Factor Calculation

The indexation rate for the 2022 year is 3.9%, calculated according to the formula as follows:

Checking HECS HELP (etc) loan balance

For checking loan balances, use my.gov.au or myhelpbalance.gov.au. To access the latter you need your Commonwealth Higher Education Student Support Number (CHESSN), Student ID number and date of birth to log in.

Long Term New Zealander residents to get HELP

Legislation has been passed to allow access (from 1 January 2016) to HELP loans for New Zealand citizens (Special Category Visa holders) who first entered Australia as a minor and have been in Australia for 10 years, including 8 of the last 10 years, and 18 months of the last 2 years at the time of their HELP application.

Expats Non Residents Repay HELP and TLS loans and Income Reporting Threshold

Legislation has been passed (see here and here) to require Australian graduates living overseas to make HECS payments based on their income in the 2016-17 and following tax years if they earn above the HELP/TLS income thresholds. (Previously any HECS repayment from overseas debtors had been voluntary.)

From 1 January 2016 the measures require those going overseas for more than six months to register with the Tax Office. Those already overseas had until 1 July 2017 to register.

As part of the arrangements, registration through myGov is required and to lodge a tax return reporting all income.

See further: myTax 2023 Non-resident foreign income.

For 2022-23 the income reporting threshold for expats for 2022-23 is worldwide income of more than $12,090 (This threshold is calculated as 25% of the minimum repayment threshold of $48,360 for the 2022-23 year).

For 2021-22 the income reporting threshold for expats for 2021-22 is worldwide income of more than $11,753 (The threshold is calculated as 25% of the minimum repayment threshold of $47,012 for the 2021-22 year).

2020-21 The expats income reporting threshold for 2020-21 is worldwide income of more than $11,655 (calculated as 25% of the minimum repayment threshold of $46,620 for the 2020-21 year).

2019-20 The income reporting threshold for 2019-20 is worldwide income of $11,470 which is 25% of the 2019-20 minimum repayment threshold of $45,881.

2018-19 The income reporting threshold for 2018-19 is worldwide income of $12,989 (minimum repayment threshold $51,597).

Worldwide income in excess of the minimum repayment threshold triggers a repayment requirement, and part year residents may also be required to lodge a tax return. The normal deadline for reporting and payments is 31 October (unless extended via a Tax Agent).

Heading overseas? Do this:

If you have a HECS/HELP debt and intend to move overseas for 183 days or more in any 12 month period you are required to notify the Tax Office within 7 days of leaving Australia.

The notification is made online to the Tax Office via myGov. Specific instructions are here.

Trade Support Loan Scheme

Under the Trade Support Loans scheme from 1 July 2014 eligible apprentices have access to loans totalling more than $22,000 (amount is indexed annually) over the course of their apprenticeship, with the adoption of the HECS/HELP structure for repayments from tax assessments. The Tools For Your Trade grants scheme ceased on 30 June 2014.

Annual statements

From 1 June 2013 the Tax Office no longer automatically issues an annual statement of account for HELP and the Financial Supplement. The information can be obtained via the my.Gov.au website, through a myTax data pre-fill, by a Tax Agent through the Tax Portal or by phoning the Tax Office on 13 28 61.

HECS/HELP PAYG Tax Instalments

As an employee, if you are earning a high enough wage or salary (see thresholds table below) your periodic tax instalments are required to be increased to include an extra amount from each pay to repay the HECS or HELP loan.

HECS HELP Tax instalment schedules

Calculated tax instalment deductions for payroll purposes can be calculated from the tax instalment schedules here (including links to printable PDFs).

Any calculated repayment amount for each tax year is also detailed on your income tax assessment, along with the loan balances.

Debt Indexation Factors (See above for yearly percentage rates)

The indexation of debt balances is adjusted annually as of 1st of June. The indexation factor is calculated each year to the end of March, and is usually confirmed by May.

As at 1 June each year, indexation is applied to that part of

- the HELP loan which has been unpaid for more than 11 months (applicable from 2006) and

- the HECS loan which had been unpaid for 12 months or more (applicable from 1990 to 2005)

HELP Caps and Loan Limits

There are caps on the amount of loans available, but the loans are renewable.

Repaying loans to bring the balance under the current annual limit provides a credit balance which can be used for further loans.

The available HELP balance is the HELP loan limit of that given year, minus your HECS-HELP, FEE-HELP, VET FEE-HELP and VET Students Loans borrowing.

The combined HELP loan limit for most students includes all FEE-HELP, VET FEE-HELP, VET Students Loans and HECS-HELP with a census date from 1 January 2020.

Students studying specific courses including medicine, dentistry, veterinary science and eligible aviation courses have separately specified loans and limits.

| 2024 | 2023 | 2022 | 2021 | |

| General HELP loan limit | $121,844 | $113,028 | $109,206 | $108,232 |

| Loan Limit for medicine, dentistry, vet science, aviation | $174,998 | $162,336 | $156,847 | $155,448 |

For further information see this page at studyassist.com.au

Repayment Income – Adjusted Taxable Income

The calculation of income for repayment purposes has an expanded definition – your repayment assessment is based on your “repayment income“, which is calculated as follows:

= Taxable income plus the following

+ Total net investment loss (which includes net rental losses)

+ Total reportable fringe benefits amounts

+ Reportable super contributions

+ Exempt foreign employment income

= Repayment Income

Income thresholds are inflation-adjusted each year. Additionally, if you are entitled to a Medicare reduction or exemption due to low family income, a compulsory repayment is not required for that year.

HELP relief for rural doctors and nurse practitioners

The government has introduced measures to relieve HELP debts for eligible rural and remote doctors and nurse practitioners who live and work in the most remote areas of Australia.

The scheme starts from1 January 2022.

It is available to eligible doctors and nurse practitioners who have an outstanding HELP debt at the time they commence eligible work on or after 1 January 2022.

Full or partial remission of HELP debt is provided, depending on the remote classification and period spent.

See:

Voluntary Payments Discount (Ended 31 Dec 2022)

From 1 January 2021 a scheme provided that an up-front payment of $500 or more or equal to 90 per cent of your student contribution amount received a 10% discount.

This scheme ended 31 December 2022.

However, you can still make voluntary payments any time.

They are not refundable, but from 2019-20 onwards will contribute to your “HELP Balance” which can be utilized against future fees.

See further:

Waiver for very remote teachers

Legislation has been passed which provides HELP loan remissions for teachers who commence teaching in very remote locations on or after 14 February 2019 (being the commencement of the 2019 school year).

The scheme starts by providing relief from debt indexation for the time spent teaching in a remote area, and after a qualifying period (basically 4 years) enables a loan waiver.

Who are the eligible remote teachers?

The teachers are those teaching in any of:

– a school providing primary or secondary education

– a centre based day care service or

– a preschool

Where are the eligible very remote teaching areas?

The remote areas are designated on government lists.

What are the benefits, and when do they apply?

There are two parts to the benefit.

- Relief from loan indexation for the period(s) spent teaching in a designated area.

- Remission of the HELP loan itself.

Remission of debt is available after a 4 year qualifying period of teaching in a very remote area, and on that basis will first be available from 2023.

The requirements are for the completion of 4 years full time within a six-year period (from Feb 2019), or the equivalent pro-rated part time.

The remission applies to HELP debt from the cost of obtaining your initial teacher education qualification (max 5 years) in either Commonwealth supported or full fee paying courses. Any remission is limited to the amount of debt at the time of commencing service in a very remote area.

Guidelines for the scheme were update in 2023. See HELP Debtor Guidelines (Teachers) 2023

How can you get the remote teacher benefits?

Debt remission (available from 2023): Details for remitting very remote teachers HELP debt and links to the application form are set out here.

HECS-HELP Bonus Debt Reductions For Specific Occupations (note: this scheme has ended)

Note: In the 2014 Budget the Government announced that the HECS-HELP benefit scheme will end.

Amending legislation has been passed by parliament which terminates benefits after 30 June 2017 see Budget Savings (Omnibus) Bill 2016 and further details of the phase-out arrangements here.

Time limits: Graduates have a maximum of 2 years after the relevant year to claim the benefit with no extensions permissible. Deadlines are:

| Income year | Application Deadline |

| 2016-17 | 30 June 2019 |

| 2015-16 | 30 June 2018 |

| 2014-15 | 30 June 2017 |

To encourage specific occupations repayment reductions are available for graduates employed in specific occupational areas, with the reduction amounts indexed annually, applied for after the end of the financial year. There is a fixed claim period of 2 years from the end of the financial year.

The purpose of the benefit is designed to encourage graduates into employment in their field. The favoured course types are:

- early childhood education (ECE)

- maths and science

- education

- nursing (including midwifery)

The maximum benefit amounts for each tax year are:

| Income year | Early childhood education | Maths/science | Education and nursing |

| 2016-17 | $1,947.17 | $1,825.46 | $1,825.46 |

| 2015-16 | $1,918.39 | $1,798.48 | $1,798.48 |

| 2014-15 | $1,878.93 | $1,761.49 | $1,761.49 |

| 2013–14 | $1,831.32 | $1,716.85 | $1,716.85 |

| 2012–13 | $1,795.41 | $1,683.19 | $1,683.19 |

| 2011–12 | $1,744.81 | $1,635.75 | $1,635.75 |

| 2010–11 | $1,693.99 | $1,588.11 | $1,588.11 |

| 2009–10 | $1,662.40 | $1,558.50 | $1,558.50 |

| 2008–09 | $1,600.00 | $1,500.00 | Not applicable |

Source: studyassist.gov.au

Further HECS HELP Information Sources

- HELP and other student loans: a quick guide (2023)

- SFSS Repayments

- Work related self education expenses

- Debt cancellation – special circumstances

- Applying for the benefit (no longer current)

FAQ Questions and Answers

Is HECS debt automatically deducted?

If your income reaches the level where a loan repayment is required, the amount will be automatically calculated as a percentage of your repayment income and added to your income tax assessment calculation

How much do you pay back on HECS?

The repayment percentage depends on your income. There are different percentages at different income levels which are indexed every year. The current repayment income levels and percentages are listed above.

What happens when I pay off my HECS debt?

When you have paid off your HECS debt the balance will be recorded as zero and consequently the percentage surcharge will no longer be added to your annual tax assessment.

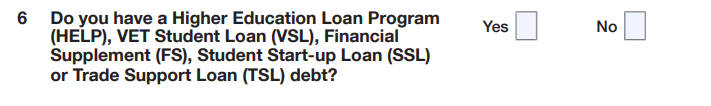

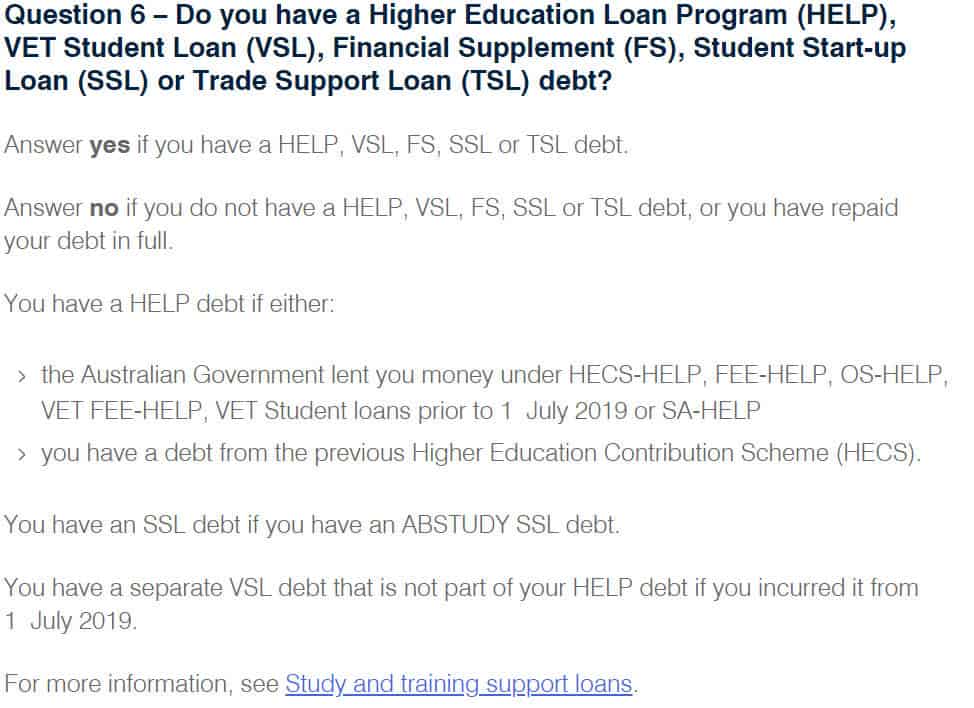

You should also lodge a fresh tax withholding declaration with your employer to ensure that the higher HECS-included tax withholding rate is no longer being applied. Select “no” at question 6.

If the higher rate of tax has been collected after the HECS loan has been paid off, the excess tax will appear as a credit in your next tax assessment.

Should I pay off my HECS?

HECS is a loan, and the timing and manner of a voluntary repayment is a financial decision based on your circumstances. So advice cannot be offered here, but some comments may help.

Firstly, bear in mind that HECS is a special kind of loan from the government. ‘Special’ because it is not subject to interest, and will only be repayable if your income reaches the specified levels.

However although interest is not payable, the unpaid balance of the loan goes up every year by the amount of inflation. The annual inflation factor is updated every year as of 1 June, and for the last couple of years until 2022 have been relatively low.

On 1 June 2023 due to general inflation in the economy, the indexation factor took a leap from 3.9% to 7.1%, significantly adding to debt levels.

Among further concerns, which have been aired in the media, has been the mechanism of the indexation applying as it does to the balance at a specific date (1 June) which then is reflected in a repayment included in your tax assessment at a later date.

At this later date, further repayments are not taken into account, and won’t be, until the following year’s indexation. These timing issues can have the effect of a much higher interest rate (even though it’s not labelled as interest) than the nominal inflation rate applied as an indexation percentage.

If you have spare cash, then one (but not the only) fundamental decision is whether your cash can be invested to earn more than the index inflation rate in an alternative investment, or, for example, by repaying HECS debt with a higher after-tax interest rate such as a car loan.

These are questions for you and your financial advisor after taking into account your overall life-style, financial goals and financial capacity, and consideration of investment alternatives.

Caution: If you are intending to beat the annual 1 June indexation loan increase by making a voluntary payment, be aware that the Tax Office need “enough time for the payment to be received and processed” prior to 1 June, otherwise you may be stuck with the indexation increase even though you have made full payment. How long is “enough time” is not spelled out, and will somewhat depend on your bank and the payment method.

How much HECS do I pay?

The HECS repayment schedule changes each year as the income bands and debt amount are both indexed to inflation.

The PAYG tax deduction schedules automatically take care of this if you tick the correct box in the tax withholding declaration, so at the end of the year when you lodge your tax return you shouldn’t have any more to pay (all things being equal).

That won’t apply if you’re working overseas, as there’s a separate procedure for non-residents.

If you expect that enough tax instalments haven’t been made, or if you are just curious, you can refer to the HECS repayment schedules above to estimate how much the bill will be. Based on your estimate of ‘repayment income’, the repayment table provides a corresponding flat percentage of the indexed loan amount required to be paid. ‘Repayment income’ is taxable income plus a few other items – you can check the repayment income formula here.

Indexation occurs in June (based on March CPI) and so you may need to estimate that as well, to determine the debt value.

Once you have your income and debt balance estimates, the calculation is quite simple: the repayment amount is the debt value multiplied by the percentage which corresponds to the estimated income.

What happens to HECS when I retire?

HECS debts stay with you for life until repaid, and will follow you into retirement. Retirement income, or more specifically ‘repayment income‘ will be subject to the current repayment schedule as outlined above.

What happens to HECS when I die?

HECS debts are recoverable up to the date of death. The trustee or other executor of a deceased person’s estate needs to facilitate the final tax return, on which a tax assessment will incorporate any HECS loan repayment amount based on the current income schedule.

After death any remaining debt is cancelled. See studyassist.gov.au

HECS-HELP Repayment Rates and Income Thresholds 2019-20

Also includes VET FEE-HELP, OS-HELP, SA-HELP and VET Student Loans

Thresholds extended and lifetime caps – see the notes underneath this table *

| Income more than or equal to.. | ..and less than | Repayment rate |

| $0 | $45,881 | Nil |

| $45,881 | $52,974 | 1% |

| $52,974 | $56,152 | 2% |

| $56,152 | $59,522 | 2.5% |

| $59,522 | $63,093 | 3% |

| $63,093 | $66,878 | 3.5% |

| $66,878 | $70,891 | 4% |

| $70,891 | $75,145 | 4.5% |

| $75,145 | $79,653 | 5% |

| $79,653 | $84,433 | 5.5% |

| $84,433 | $89,499 | 6% |

| $89,499 | $94,869 | 6.5% |

| $94,869 | $100,561 | 7% |

| $100,561 | $106,594 | 7.5% |

| $106,594 | $112,990 | 8% |

| $112,990 | $119,770 | 8.5% |

| $119,770 | $126,956 | 9% |

| $126,956 | $134,573 | 9.5% |

| $134,573 | ∞ | 10% |

* Extended HELP repayment thresholds from 1 July 2019

[News May 1, 2017] The Minister Simon Birmingham announced the introduction a new (lower) income repayment thresholds as well as higher threshold bands increasing to a top 10% repayment rate. Initially intended to start from 1 July 2018, the proposed thresholds and rates were by amendment to the Bill modified and deferred until the 2019-20 and later years. The minimum repayment threshold for the 2019-20 financial year moved to $45,881, and the thresholds will be indexed in the years after 2019-20.

HECS HELP Repayment Rates and Income Thresholds 2018-19

| Income | Repayment rate |

| up to $51,957 | Nil |

| $51,957 – $57,729 | 2% |

| $57,730 – $64,306 | 4% |

| $64,307 – $70,881 | 4.5% |

| $70,882 – $74,607 | 5% |

| $74,608 – $80,197 | 5.5% |

| $80,198 – $86,855 | 6% |

| $86,856 – $91,425 | 6.5% |

| $91,426 – $100,613 | 7% |

| $100,614 – $107,213 | 7.5% |

| $107,214 and above | 8% |

HECS HELP Repayment Rates and Income Thresholds 2017-18

| Repayment income | Repayment rate |

| Below $55,874 | Nil |

| $55,874 – $62,238 | 4.0% |

| $62,239 – $68,602 | 4.5% |

| $68,603 – $72,207 | 5.0% |

| $72,208 – $77,618 | 5.5% |

| $77,619 – $84,062 | 6.0% |

| $84,063 – $88,486 | 6.5% |

| $88,487 – $97,377 | 7.0% |

| $97,378 – $103,765 | 7.5% |

| $103,766 and above | 8.0% |

HECS/HELP Repayment Rates and Income Thresholds 2000-01 to 2016-17

| 2016 – 17 | |

| Repayment income | Repayment rate |

| Below 54,868 | Nil |

| 54,869 to 61,119 | 4.00% |

| 61,120 to 67,368 | 4.50% |

| 67,369 to 70,909 | 5.00% |

| 70,910 to 76,222 | 5.50% |

| 76,223 to 82,550 | 6.00% |

| 82,551 to 86,894 | 6.50% |

| 86,895 to 95,626 | 7.00% |

| 95,627 to 101,899 | 7.50% |

| 101,900 and above | 8.00% |

| 2015 – 16 | |

| Repayment income | Repayment rate |

| Below 54,126 | Nil |

| 54,126 to 60,292 | 4.00% |

| 60,293 to 66,456 | 4.50% |

| 66,457 to 69,949 | 5.00% |

| 69,950 to 75,190 | 5.50% |

| 75,191 to 81,432 | 6.00% |

| 81,433 to 85,718 | 6.50% |

| 85,719 to 94,331 | 7.00% |

| 94,332 to 100,519 | 7.50% |

| 100,520 and above | 8.00% |

| 2014 – 15 | |

| Repayment income | Repayment rate |

| Below 53,345 | Nil |

| 53,345 to 59,421 | 4.00% |

| 59,422 to 65,497 | 4.50% |

| 65,498 to 68,939 | 5.00% |

| 68,940 to 74,105 | 5.50% |

| 74,106 to 80,257 | 6.00% |

| 80,258 to 84,481 | 6.50% |

| 84,482 to 92,970 | 7.00% |

| 92,971 to 99,069 | 7.50% |

| 99,070 and above | 8.00% |

| 2013 – 14 | |

| Repayment income | Repayment rate |

| Below 51,309 | Nil |

| 51,309 to57,153 | 4.00% |

| 57,154 to 62,997 | 4.50% |

| 62,998 to 66,308 | 5.00% |

| 66,309 to 71,277 | 5.50% |

| 71,278 to 77,194 | 6.00% |

| 77,195 to 81,256 | 6.50% |

| 81,257 to 89,421 | 7.00% |

| 89,422 to 95,287 | 7.50% |

| 95,288 and above | 8.00% |

| 2012 – 13 | |

| Repayment income | Repayment rate |

| Below 49,096 | Nil |

| 49,096 to 54,688 | 4.00% |

| 54,689 to 60,279 | 4.50% |

| 60,280 to 63,448 | 5.00% |

| 63,449 to 68,202 | 5.50% |

| 68,203 to 73,864 | 6.00% |

| 73,865 to 77,751 | 6.50% |

| 77,752 to 85,564 | 7.00% |

| 85,565 to 91,177 | 7.50% |

| 91,178 and above | 8.00% |

| 2011 – 12 | |

| Repayment income | Repayment rate |

| Below 47,196 | Nil |

| 47,196 to 52,572 | 4.00% |

| 52,573 to 57,947 | 4.50% |

| 57,948 to 60,993 | 5.00% |

| 60,994 to 65,563 | 5.50% |

| 65,564 to 71,006 | 6.00% |

| 71,007 to 74,743 | 6.50% |

| 74,744 to 82,253 | 7.00% |

| 82,254 to 87,649 | 7.50% |

| 87,650 and above | 8.00% |

| 2010 – 11 | |

| Repayment income | Repayment rate |

| Below 44,912 | Nil |

| 44,912 to 50,028 | 4.00% |

| 50,029 to 55,143 | 4.50% |

| 55,144 to 58,041 | 5.00% |

| 58,042 to 62,390 | 5.50% |

| 62,391 to 67,570 | 6.00% |

| 67,571 to 71,126 | 6.50% |

| 71,127 to 78,273 | 7.00% |

| 78,274 to 83,407 | 7.50% |

| 83,408 and above | 8.00% |

| 2009 – 10 | |

| Repayment income | Repayment rate |

| Below 43,151 | Nil |

| 43,151 to 48,066 | 4.00% |

| 48,067 to 52,980 | 4.50% |

| 52,981 to 55,764 | 5.00% |

| 55,765 to 59,953 | 5.50% |

| 59,954 to 64,919 | 6.00% |

| 64,920 to 68,336 | 6.50% |

| 68,337 to 75,203 | 7.00% |

| 75,204 to 80,136 | 7.50% |

| 80,137 and above | 8.00% |

| 2008 – 09 | |

| Repayment income | Repayment rate |

| Below 41,595 | Nil |

| 41,595 to 46,333 | 4.00% |

| 46,334 to 51,070 | 4.50% |

| 51,071 to 53,754 | 5.00% |

| 53,755 to 57,782 | 5.50% |

| 57,783 to 62,579 | 6.00% |

| 62,580 to 65,873 | 6.50% |

| 65,874 to 72,492 | 7.00% |

| 72,493 to 77,247 | 7.50% |

| 77,248 and above | 8.00% |

| 2007 – 08 | |

| Repayment income | Repayment rate |

| Below 39,825 | Nil |

| 39,826 to 44,360 | 4.00% |

| 44,361 to 48,896 | 4.50% |

| 48,897 to 51,466 | 5.00% |

| 51,467 to 55,322 | 5.50% |

| 55,323 to 59,915 | 6.00% |

| 59,916 to 63,068 | 6.50% |

| 63,069 to 69,405 | 7.00% |

| 69,406 to 73,959 | 7.50% |

| 73,960 and above | 8.00% |

| 2006 – 07 | |

| Repayment income | Repayment rate |

| Below 38,148 | Nil |

| 38,149 to 42,494 | 4.00% |

| 42,495 to 46,838 | 4.50% |

| 46,839 to 49,300 | 5.00% |

| 49,301 to 52,994 | 5.50% |

| 52,995 to 57,394 | 6.00% |

| 57,395 to 60,414 | 6.50% |

| 60,415 to 66,485 | 7.00% |

| 66,486 to 70,846 | 7.50% |

| 70,847 and above | 8.00% |

| 2005 – 06 | |

| Repayment income | Repayment rate |

| Below 36,185 | Nil |

| 36,186 to 40,306 | 4.00% |

| 40,307 to 44,427 | 4.50% |

| 44,428 to 46,762 | 5.00% |

| 46,763 to 50,266 | 5.50% |

| 50,267 to 54,439 | 6.00% |

| 54,440 to 57,304 | 6.50% |

| 57,305 to 63,062 | 7.00% |

| 63,063 to 67,199 | 7.50% |

| 67,200 and above | 8.00% |

| 2004 – 05 | |

| Repayment income | Repayment rate |

| Below 35,000 | Nil |

| 35,001 to 38,987 | 4.00% |

| 38,988 to 42,972 | 4.50% |

| 42,973 to 45,232 | 5.00% |

| 45,233 to 48,621 | 5.50% |

| 48,622 to 52,657 | 6.00% |

| 52,658 to 55,429 | 6.50% |

| 55,430 to 60,971 | 7.00% |

| 60,972 to 64,999 | 7.50% |

| 65,000 and above | 8.00% |

| 2003 – 04 | |

| Repayment income | Repayment rate |

| Below 25,348 | Nil |

| 25,348 to 26,731 | 3.00% |

| 26,732 to 28,805 | 3.50% |

| 28,806 to 33,414 | 4.00% |

| 33,415 to 40,328 | 4.50% |

| 40,329 to 42,447 | 5.00% |

| 42,448 to 45,628 | 5.50% |

| 45,629 and above | 6.00% |

| 2002 – 03 | |

| Repayment income | Repayment rate |

| Below 24,365 | Nil |

| 24,365 to 25,694 | 3.00% |

| 25,695 to 27,688 | 3.50% |

| 27,689 to 32,118 | 4.00% |

| 32,119 to 38,763 | 4.50% |

| 38,764 to 40,801 | 5.00% |

| 40,802 to 43,858 | 5.50% |

| 43,859 and above | 6.00% |

| 2001 – 02 | |

| Repayment income | Repayment rate |

| Below 23,242 | Nil |

| 23,242 to 24,510 | 3.00% |

| 24,511 to 26,412 | 3.50% |

| 26,413 to 30,638 | 4.00% |

| 30,639 to 36,977 | 4.50% |

| 36,978 to 38,921 | 5.00% |

| 38,922 to 41,837 | 5.50% |

| 41,838 and above | 6.00% |

| 2000 – 01 | |

| Repayment income | Repayment rate |

| Below 22,346 | Nil |

| 22,346 to 23,565 | 3.00% |

| 23,566 to 25,393 | 3.50% |

| 25,394 to 29,456 | 4.00% |

| 29,457 to 35,551 | 4.50% |

| 35,552 to 37,420 | 5.00% |

| 37,421 to 40,223 | 5.50% |

| 40,224 and above | 6.00% |

HELP Startup Year Accelerator Program

The Higher Education Loan Program Startup Year accelerator programs is designed to assist recent graduates in starting their businesses.

It provides income-contingent loans to cover living expenses for the first year.

The loans are interest-free, and repayments only commence once the individual’s income reaches a specific threshold.

The program’s eligibility and application process are detailed at education.gov.au.

This initiative is intended foster innovation and support the broader startup community.

Currently, the program is in its pilot phase, and the Department of Education is actively seeking participation from Australian universities.

Key Eligibility Criteria for the Startup Year Accelerator Loan Program (STARTUP-HELP):

- Who can apply?

- Postgraduates.

- Undergraduates in their final year.

- Recent graduates.

- Study Load Restrictions:

- There’s no expectation that students would undertake both a full-time undergraduate load and a full-time Startup course load simultaneously.

- Possible models:

- The Startup Year course can be taken alongside a reduced undergraduate load.

- The Startup Year course may be a full-time load and undertaken when the student isn’t taking any undergraduate units.

- Subject to education provider approval, students will not receive STARTUP-HELP assistance if their commitments would collectively exceed an EFTSL value of more than 2.

- Course Requirements:

- The Startup Year course should result in the award of a qualification.

- Non-AQF qualifications, including microcredentials, could satisfy the requirement for Startup Year courses to result in a qualification award, but it doesn’t include “microcredential courses” as specified in Schedule 1 of the Higher Education Support Act 2003 due to EFTSL requirements.

- Course Fees:

- The maximum fee for an accelerator program course should not exceed $11,800 for a one EFTSL course, which is linked to the 2023 funding cluster rates for units of study in Medicine, Dentistry, or Veterinary Science.

Full details of the progress of this pilot program are provided at education.gov.au.

See also:

This page was last modified 2024-04-20