The concessional contributions tax rate on super is 15%. For higher income earners with income over $250,000, the rate is 30%.

Superannuation contributions tax rules within limits provide a legal way to shield income from tax at normal rates, and build up retirement savings in the lower-taxed environment of a super fund.

Tax Increase On Funds Over $3 million Proposed From 1 July 2025

In legislation proposed to take effect from the 2025‑26 tax year, the concessional tax rate that individuals with total superannuation balances of $3 million or more receive on annual earnings will be 30%, rather than 15%.

The 30% tax rate will not be retrospective and is intended to apply only to relevant earnings from the 2025-26 year onwards from fund assets above $3 million in value. As the proposal currently stands, the value includes unrealised gains.

See: Minister’s press release and draft legislation.

Div 293 Tax Thresholds

With effect from 1 July 2017 the threshold at which high-income earners pay Division 293 tax on their concessional taxed contribution to superannuation) was reduced from $300,000 to $250,000. See Treasury Laws Amendment (Fair and Sustainable Superannuation) Bill 2016.

| Tax Year | Threshold |

| From 1 July 2017 onwards | $250,000 |

| From 1 July 2012 to 30 June 2017 | $300,000 |

In general, tax deductible (“concessional“) superannuation contributions are taxed when received by a complying super fund at the rate of 15%.

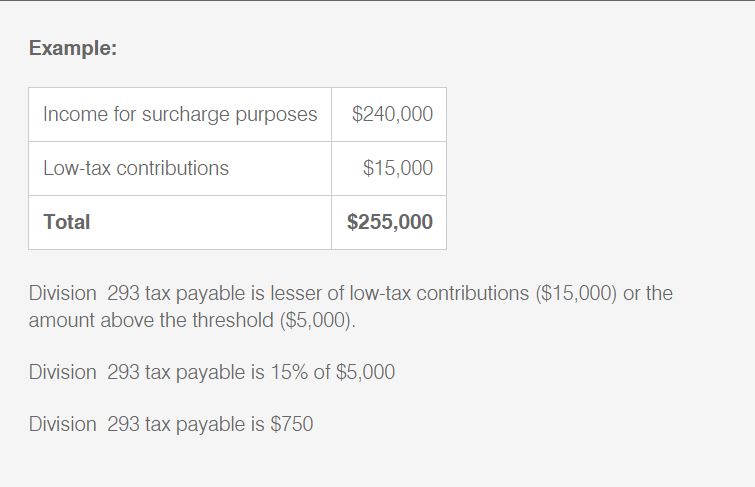

Higher income earners are subject to an additional 15% on the over-$250,000 (over-$300,000 before 1 July 2017) slice of (income + contributions) under Division 293 which has applied since 1 July 2012.

Debt account interest – defined benefit interests

Payment of the Div 293 tax is deferred on defined benefit interests until a super benefit is actually paid. Payment of the the benefit crystallises the taxable amount and interest accumulates until that point.

The Tax Office calculates a “debt account” for each defined benefit interest for which Division 293 tax has been deferred. The interest is applied at the end of the tax year based on the Average 10-year Treasury bond rate for the preceding year.

Division 293 Notices

If your income plus low-tax super contributions add up to more than the threshold (see table above) there is an extra 15% tax on the taxable contributions.

These are referred to as “Division 293” assessments. The first issue of these assessments were for the 2012-13 tax year in February 2014.

Source: ato.gov.au

Tax-Free Contributions

Non-tax deductible contributions, (also referred to as undeducted or non-concessional contributions) are not taxed at all, and ultimately can be withdrawn tax free.

There are times when it’s convenient or tax-preferable to make super contributions without claiming a tax deduction. This is to take advantage of a complying super fund’s investment income being taxed at the concessional rate of 15%, as well as (normally, and subject to limitations) being entitled to dividend franking credits.

This can result in the overall tax rate on the investments earnings being lower than it would otherwise have been if the investment income had been earned directly in the hands of an individual taxpayer paying tax at the tax scale marginal rates.

Annual contribution caps apply to limit access to the concessions.

Contributions Tax Is Paid By The Super Fund (not you)

Tax on superannuation contributions is paid by the super fund.

Thus in cash flow terms the tax normally comes from the contribution itself or the fund, and won’t directly impact your personal income tax assessment or cash flow.

Contributions form part of a complying super fund’s taxable income , generally taxed at 15%, but with effective tax rates of 47% or even higher if qualifying conditions are not fully met.

Superannuation Contributions Taxing Rates – a Summary 3

| Complying concessional (tax deductible) contributions within allowable limits to a complying fund (non-high income earners) | 15% |

| “Breach” circumstances, such as contributions in excess2 of specified limits before 1 July 2013, or to a non-complying fund | 47%* |

| From 1 July 2012: Higher income earners 1 concessional contributions within allowable limits to a complying fund – on the amount of the over-$250,000 ($300,000 before 1 July 2017) slice of (income + contributions) – Division 293 assessments | 30% (i.e. 15% + 15%) |

| Refunded contributions since 30 June 2013 (see excess) | Marginal rate + interest |

1 Applies to the excess over $250,000 ($300,000 before 1 July 2017) the income for surcharge purposes (other than reportable super contributions) Plus low tax contributions. For further info, see the EM for the Bill which passed through Federal parliament in late June 2013.

2 Contributions caps information is tabulated here and the changing treatment of excess contributions since 1 July 2011 is summarised here. * Includes medicare levy, 49% from 2014-15 to 2016-17.

3 Other than contributions, this article does not deal with the taxing of superannuation funds as such, which can derive other kinds of income taxed at varying rates according to circumstances and status.

Lower Income Earners Superannuation Tax Offset

For lower income earners (less than $37,000 a year) from 1 July 2012 until 30 June 2017 the Low Income Superannuation Contribution (“LISC”) scheme was in place, which is a refund of the 15% contributions tax up to a maximum of $500.

The Mining Tax repeal measures which gained the approval of Federal Parliament on 2 September 2014 provide for the removal of LISC from 1 July 2017.

From 1 July 2017 the Low Income Superannuation Tax Offset commenced, which operates in similar terms to effectively refund the 15% contributions tax to a maximum of $500 (i.e. equivalent to $3,333 on concessional contributions).

See also

This page was last modified 2023-10-03