Medical Expenses Tax Offset (NMETO)

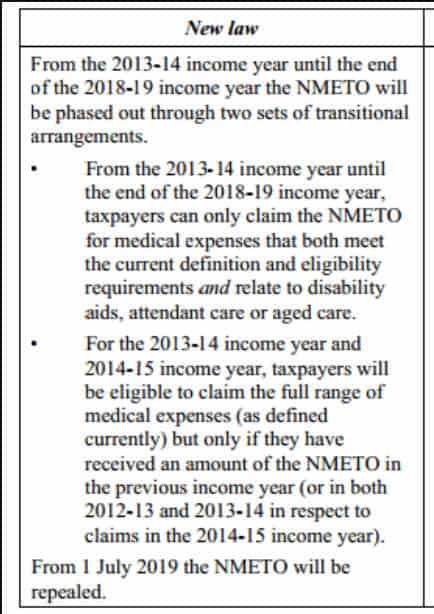

The Net Medical Expenses Offset was phased out over the period from 1 July 2013 to 30 June 2019. From the 2019-20 and later years no offset is available.

From 1 July 2019 this offset has been abolished.

From 2015-16 (until 2018-19) transitional arrangements only allow claims for disability aids, attendant care or aged care expenses.

otherwise, for the full range of medical expenses

- A claim can only be made in the 2013-14 year if a rebate had been received in 2012-13

- A claim can be made in 2014-15 only if a rebate had been received in 2013-14

“received” means that a rebate amount greater than nil had been included in the tax assessment. Sec 159P(1C)

Indexation of the claim thresholds is adjusted after 31 March each year.

On this page:

NMETO Claim Calculation

The medical expenses tax rebate is calculated as follows:

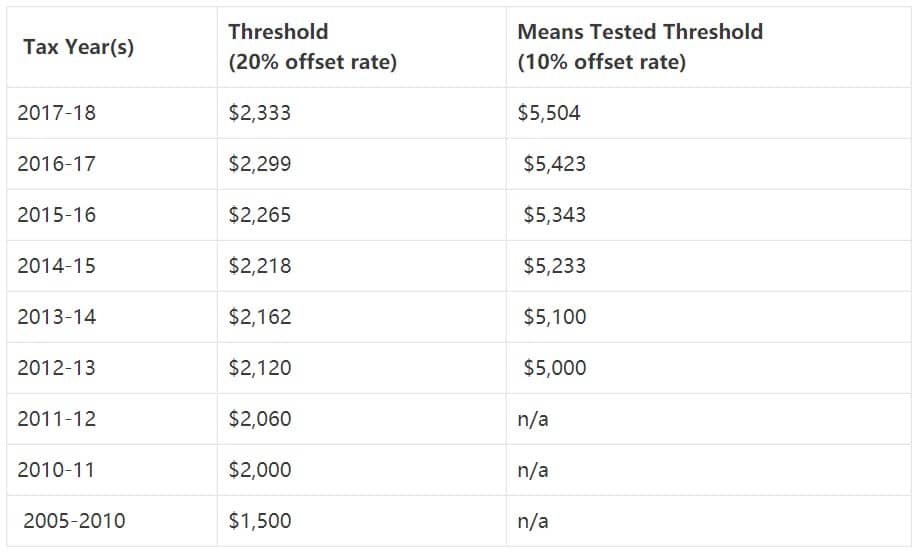

NMETO 2018-19

- 20% of eligible expenses only* above the threshold of $2,377

- except for higher income earners for whom the offset is 10% of net medical expenses above a claim threshold of $5,609

NMETO 2017-18

- 20% of eligible expenses only* above the threshold of $2,333

- except for higher income earners for whom the offset is 10% of net medical expenses above a claim threshold of $5,504

* Eligible expenditure from 2015-16 onwards is restricted to disability aids, attendant care or aged care. For more complete information in this regard, go here.

NMETO 2016-17

- 20% of eligible expenses only* above the threshold of $2,299

- except for higher income earners for whom the offset is 10% of net medical expenses above a claim threshold of $5,423

* Eligible expenditure from 2015-16 onwards is restricted to disability aids, attendant care or aged care. For more complete information in this regard, go here.

NMETO 2015-16

- 20% of eligible expenses only* above the threshold of $2,265

- except for higher income earners for whom the offset is 10% of net medical expenses above a claim threshold of $5,343

* Eligible expenditure from 2015-16 onwards is restricted to disability aids, attendant care or aged care. For more complete information in this regard, go here.

NMETO 2014-15

- 20% of net medical expenses above the threshold of $2,218

- except for higher income earners for whom the offset is 10% of net medical expenses above a claim threshold of $5,233

NMETO 2013-14

- 20% of net medical expenses above the threshold of $2,162

- except for higher income earners for whom the offset is 10% of net medical expenses above a claim threshold of $5,100

NMETO 2012-13

- 20% of net medical expenses above the threshold of $2,120

- except for higher income earners for whom the offset is 10% of net medical expenses above a claim threshold of $5,000

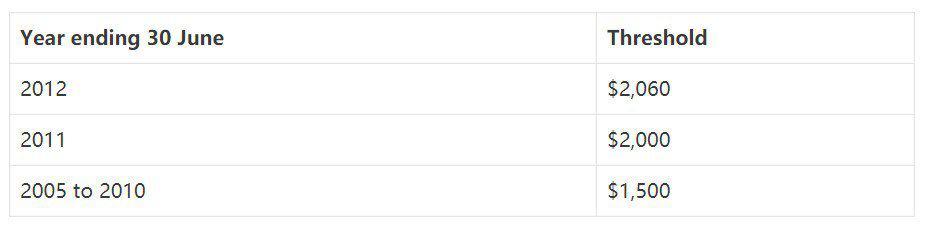

NMETO 2011-12 and earlier

20% of net medical expenses above the respective thresholds

Residence requirement

The offset claim is reserved for resident taxpayers, including a current spouse and (broadly) dependants (see below).

Eligible medical expenses – what’s included

From 2015-16 (until 2018-19) transitional arrangements only allow claims for disability aids, attendant care or aged care expenses.

What qualifies as medical expenses is legally defined, but quite wide-ranging. In general it is restricted to payments to legally registered practitioners, for an illness or operation or for medical conditions.

- This includes payments to or for doctors, nurses, chemists, dentists and public and private hospitals. It excludes cosmetic procedures which Medicare doesn’t support, and claims cannot include expense amounts reimbursed under Medicare or health insurance cover.

- See here for Allowable medical expenses

Phase-out of medical expenses claims

From 2015-16 (until 2018-19) transitional arrangements only allow claims for disability aids, attendant care or aged care expenses.

Medical Expenses – Who For?

The medical expenses you can claim are limited to yourself and your spouse, and certain dependent relatives subject to qualifying conditions:

- children under 21 years or student children under 25 years

- child housekeeper

- invalid relatives

=> See Claimable Family

Offset is not refundable

Medical Expense Offsets are not refundable if the amount of the offset is greater than your tax payable.

Net Medical Expenses Tax Offset rates and Thresholds

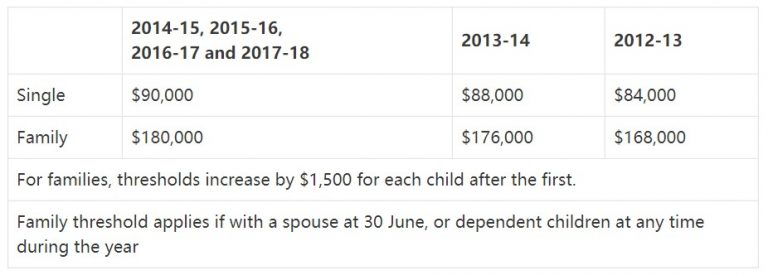

Higher Income Earners – From 1 July 2012 income-tested

From 1 July 2012 the rebate is subject to an income test which is based on the Medicare levy surcharge income minimum thresholds. Higher income earners have a reduced offset rate of 10% and a higher minimum expenses threshold (over $5,000).

The income test is based on Adjusted Taxable Incomes with respect to the Medicare levy surcharge higher income thresholds.

- “Adjusted Taxable Income” is your declared taxable income with certain fringe benefits, exempt income and losses added back – see ATI

‘Higher Income’ Thresholds

Change to Adjusted Taxable Income Formula

The meaning of ‘adjusted fringe benefits total’ is modified so that the gross value rather than adjusted net value (previously 51%) of reportable fringe benefits is used, except for PBIs, hospitals and charities.

The government has adjusted the formula for the inclusion of the value of fringe benefits in Adjusted Taxable Income.

‘adjusted fringe benefits total’ is a component of Adjusted Taxable Income

This affects eligibility for:

- family tax benefits, stillborn baby payment,child care benefit, Youth Allowance, Abstudy and Isolated Children’s Allowance

- parental leave pay and dad and partner pay

- net medical expenses offset

- dependant (invalid and carer) (DICTO) tax offset

- Notional dependent’s offset for the Zone & overseas personnel tax offsets

For details of the amending legislation see Budget Savings (Omnibus) Act 2016 (Schedule 15). The measures received royal assent on 16 September 2016 and according to its terms therefore take effect from 1 January 2017 for family assistance payments and for income tax tests from 1 July 2017.

Medical Expense Offset claim calculation

Subject to entitlement, the procedure for working out a Medical Expense Offset claim is as follows:

- Determine eligible expenditures paid within the tax year

- Ensure all reimbursements are deducted

- Deduct your minimum threshold amount for that tax year – determined by income

- Multiply the result by 20% (or 10% in 2012-13 and later years depending on income)

- The result is your Medical Expenses Tax Offset which is deducted from your tax payable, with any unused amount not refundable.

See ATO Guide to tax offsets

ATO – CPI – ITAA 1936 Sec 159P

See also

This page was last modified 2021-05-28