These are links and resources relevant to Small Businesses.

Late Tax Return Amnesty

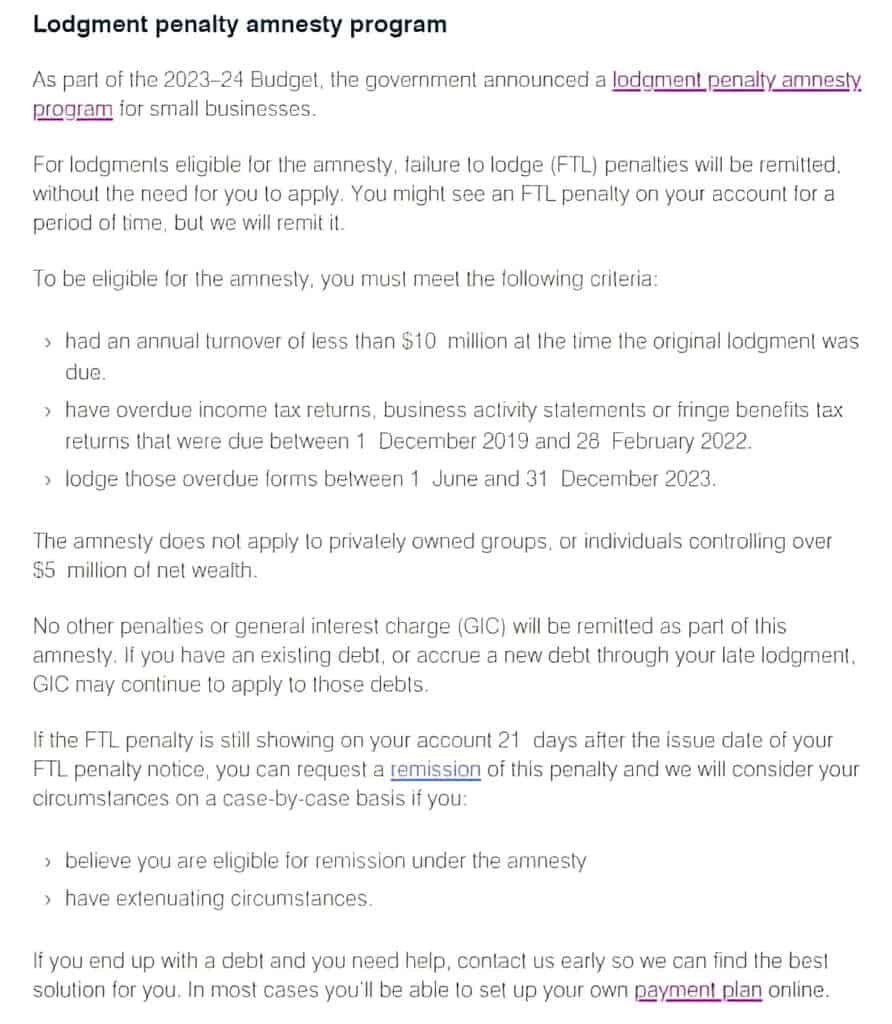

Announced as part of the 2023 Federal Budget, failure-to-lodge penalties for businesses with aggregate turnover of less than $10 million will be remitted for outstanding tax statements:

- lodged in the period from 1 June 2023 to 31 December 2023

- that were originally due in the periods 1 December 2019 to 29 February 2022.

Within the specified parameters, no action is required to request a remission of penalties.

Tax Office references: Small Business – Lodgment Penalty Amnesty Program and Media Release

2023-24 Small Business Energy Incentive

Subject to legislation and announced as part of the 2023 Budget measures, from 1 July 2023 a “bonus tax deduction” will be available of up to $20,000 on maximum expenditure of $100,000 on the cost of electrification and the more efficient use of energy.

The bonus will be available to businesses annual turnover of less than $50 million.

Total expenditure up to $100,000 will be eligible for this incentive, with the maximum additional tax deduction being $20,000 per business.

Eligible assets or upgrades must be first used or installed ready for use between 1 July 2023 and 30 June 2024.

See ATO article and Ministers’ Media Release.

Draft legislation and explanatory materials have been published on Treasury’s website.

Skills, Training And Technology 20% Deduction Boost For Small Businesses

A skills and training tax “boost” in the form of an additional 20% tax deduction on the costs of eligible employee training, will be available for small businesses (aggregated annual turnover of less than $50 million), on expenditure from 29 March 2022 until 30 June 2024.

A separate 20% deduction boost on expenditure for the uptake of digital technologies (capped at $100,000) will be available until 30 June 2023.

Skills and Training Boost

Small businesses with aggregated annual turnover of less than $50 million to get a bonus tax deduction equal to 20% of eligible expenditure for external training provided to their employees.

This is a temporary measure to incentivise small businesses to train and upskill their employees, helping to build a more productive workforce.

The amendments apply to eligible expenditure incurred, enrolments or arrangements for the provision of training made or entered into from 7:30pm (by legal time in the Australian Capital Territory) on 29 March 2022 until 30 June 2024.

Technology investment boost

Small businesses with aggregated annual turnover of less than $50 million can claim a bonus tax deduction equal to 20% of their eligible expenditure on expenses and depreciating assets for the purposes of their digital operations or digitising their operations.

The bonus deduction applies to total eligible expenditure of up to $100,000 per income year or specified time period, up to a maximum bonus deduction of $20,000 per income year or specified time period.

The amendments apply to eligible expenditure incurred from 7:30pm (by legal time in the Australian Capital Territory) on 29 March 2022 until 30 June 2023.

Draft legislation and explanatory materials have been released for comment. See:

The 20% boost for 2021-22 costs will be claimable in the 2022-23 tax return.

Boost elements incurred in the 2022-23 and 2023-24 years will be claimable in the year incurred.

See: Media Release

These measures were first announced as part of the 2022 Federal Budget.

Legislation passed 21 June 2023: see Treasury Laws Amendment (2022 Measures No 4) Bill 2022

Small Business Entity Concessions

ATO’s “Concessions at a glance” – table of business tax concessions with eligibility primarily based on aggregated turnover, compiled by the Tax Office.

They include the Instant Asset (full expensing) Deduction Rules and eligibility which apply until 30 June 2023.

Small Business CGT Concessions

A summary of the CGT concessions conditions and a free downloadable checklist

R&D Tax Incentives

Small Business Tax Discount (Offset)

How much is the small business tax offset worth, and how do you get it?

Did You Miss Out On Jobkeeper or Cash Flow Bonus?

It Might Not Be Too Late. This PDF link from Bantacs (retrieved 4 June 2021) suggests it could be worth having a crack if your business missed out.

Small Business Grants NSW

Grants, loans and financial assistance from the NSW Government including Coronavirus assistance measures.

Small Business Grants Victoria

Grants, loans and financial assistance from the Victorian Government including Coronavirus assistance measures.

Coronavirus information and support for business

From business.gov.au the latest COVID-19 government financial assistance and support measures and related news for Australian businesses.

Business Grants Australia

business.gov.au business grants and programs search tool by postcode and industry type

Buying a Business Checklists & Due Diligence

Small Business NSW Insurance Stamp Duty Exemption

Stamp Duty on Sale Of Business

A State-by-State round-up from LegalVision of the stamp duty payable on the sale of a business. Caution: this kind of info goes out of date quickly. Recommended to follow up State and Territory sources for the latest info.

Tax Implications On Sale Of A Business

Tax aspects of selling your business – Wolters Kluwer article

Family Business Succession Planning

This page was last modified 2023-07-05