Tax Tables

The tax tables in use came into force from 13 October 2020 and continue to apply through to the 2023-24 year (with limited exceptions noted below).

The Federal Budgets of 2022 and 2022-23 did not result in any changes to tax rates or income thresholds for the 2022-23 or 2023-24 income years.

The stage 3 legislated tax cuts don’t take effect until the 2024-25 income year.

From 1 July 2021, 2022 and 2023 adjusted withholding rates apply for Schedule 8 – Statement of formulas for calculating study and training support loans components (NAT 3539).

From 1 July 2021 Schedule 4 (super income streams (NAT 70982) and Schedule 13 (return to work payments (NAT 3347)) have minor content changes, but no change to the withholding rates. Full details at ato.gov.au

Note that in some circumstances specified by regulation, PAYG withholding amounts may be reduced, or reduced to nil.

Free Download

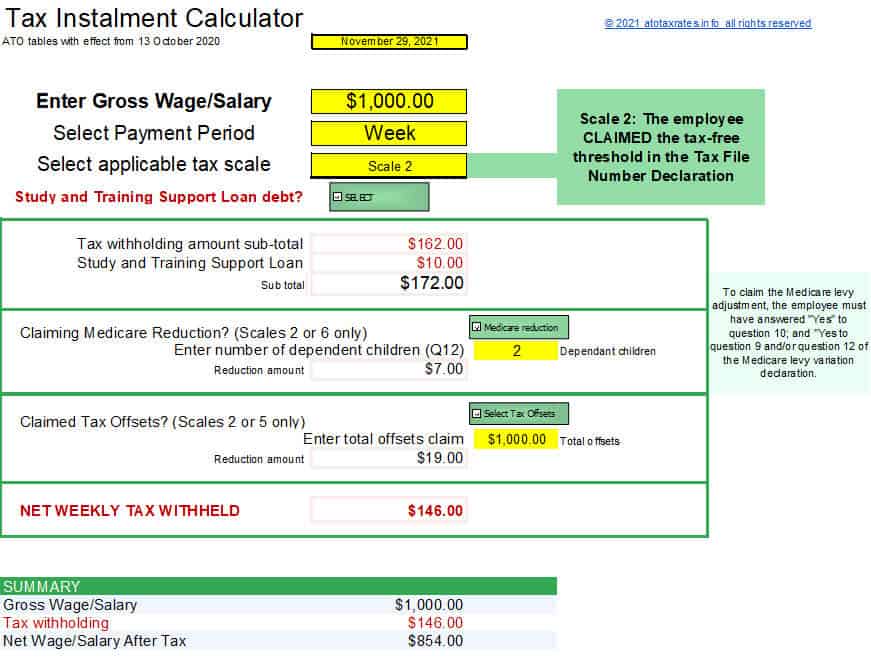

Spreadsheet Calculator Individual Tax Withholding For 2021-22-23-24

(Scales 1 to 6)

A downloadable Excel spreadsheet withholding calculator for individuals which contains the most commonly used tax scales for weekly, fortnightly, monthly and quarterly calculations.

Current tax withholding schedules

Apart from student loan repayments, these tax schedules remain unchanged through to 2023-24.

All other PDF tables are published at ato.gov.au

Previous years’ withholding schedules

See Also The Tax Office’s Mobile App

The Tax Office’s free mobile app contains a number of handy tax tools, and includes a salary and wage PAYG tax withholding calculator. Get the ATO App

Further info and sources

This page was last modified 2023-06-12