(lump sum E payments tax offset)

The delayed income tax offset is to compensate for the tax spike that occurs when a lump sum income amount received is made up of amounts which have accrued are attributable to earlier tax years.

The eligible lump sums are identified as “Lump Sum E” in the employee’s payment record.

When prior-year income is received, the whole of the amount is required to be included in the year it is received. But the delayed income offset reduces the tax to that applying when re-attributing the lump sum to the earlier years.

This earlier years’ tax adjustment is estimated by using the actual tax rates for the previous 2 years, and an average of those 2 years’ rates for any years prior to that.

Calculating the offset amount is therefore a matter of comparing the tax amounts calculated before and after the inclusion of the lump sums in the attributable years.

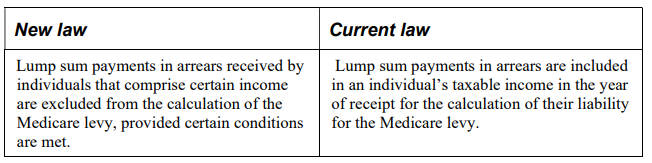

Note: An amendment set forth in the 2023 Federal Budget excludes eligible lump sum payments in arrears from the Medicare levy from 1 July 2024.

Drafts of the new measures have been published.

Eligible payments

Payments which qualify for the delayed income tax offset.

- The delayed income offset applies to “eligible income” as defined in Section 159ZR ITAA 1936.

- The lump sum payment in arrears tax offset is not available where it is less than 10% of your normal taxable income excluding the lump sum payment.

To be eligible for the offset, the lump sum income must be for arrears payments for salary or wages which accrued from periods earlier than 12 months before payment and/or

- a Commonwealth education or training payment

- reinstatement salary or wages covering a period of suspension

- deferred payment of certain retirement amounts

- compensation, sickness or accident pay for incapacity to work excluding certain insurance payments

- certain non-exempt Social Security of Veterans Affairs payments, or similar foreign payments

..and the lump sum must be 10% or more of taxable income in the year of receipt after deducting

- earlier year accrued amounts

- termination annual and long service leave and ETP amounts

- net capital gains

- taxable professional income which exceeds the average from the four preceding years

Example lump sum in arrears offset calculation

Assume a lump sum income of $140,000 was received in 2013-14 and is attributable as follows:

2013-14: $40,000

2012-13: $38,000

2011-12: $32,000

..previous years $30,000

Other income for each of the years is assumed to be:

2013-14: $20,000

2012-13: $10,000

2011-12: $5,000

Calculations:

STEP ONE: Identify the “extra” tax for the lump sum when attributed to financial years. That is a calculation of the tax that would have been payable if the income had actually been received in the year to which it relates.

The extra tax is based on a calculation of ‘notional’ tax: For the current and recent two years, the notional tax does not include medicare, but does include primary producers averaging rebate if applicable. The notional tax for the earlier years is calculated as an average percentage.

1. 2013-14 (example current tax return year)

Total income including lump sum is $160,000; tax thereon is $47,147

Income with attributed lump sum is $60,000; tax thereon is $11,047

Extra tax is the difference: $36,100

2. 2012-13 (First recent past year)

Income before lump sum $10,000; tax thereon is $zero

Income with attributed lump sum is $48,000; tax thereon is $7,147

Extra tax on attributed lump sum $38,000 is ($7,147 minus $zero) = $ 7,147

(= an average tax rate of 18.8%)

3. 2011-12 (Second recent past year)

Income before lump sum $5,000; tax thereon is $zero

Income with attributed lump sum is $37,000; tax thereon is $4,650

Extra tax on attributed lump sum $32,000 is ($4,650 minus $zero) = $4,650

(= an average tax rate of 14.5%)

4. All earlier years lump sum amount is $30,000 – the applicable tax rate is estimated by using the average of the recent past years’ average rates which is (18.8%+14.5%) ÷ 2 = 16.7%

5. The tax on $30,000 at an average rate of 16.7% comes to $5,010

STEP TWO – THE OFFSET AMOUNT

The tax offset is the current year attributable extra tax, reduced by the earlier years’ extra tax.

In this example, the offset amount is:

$36,100 – $7,147 – $4,650 – $5,010 = $19,293

How to claim the lump sum in arrears (delayed income) tax offset

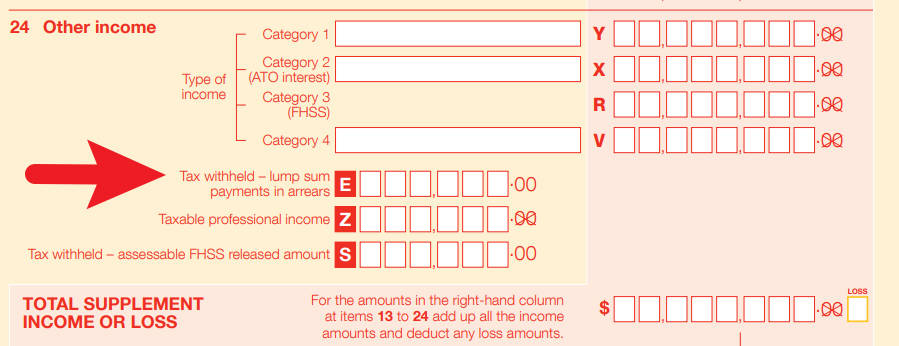

This offset is not listed separately under its own heading in the tax return. To trigger an offset claim, and a calculation by the tax office, the income amount must be identified at Item 24.

Normally lump sums in arrears paid by an employer should be identified in the payment summary as “Lump Sum E”.

The details should be entered at Item 24 of the Individual supplementary tax return, and Item 20 if foreign employment income.

To get the offset, the ATO also require a listing of the financial years to which the lump sum amount should be attributed – as a schedule to Item 24.

If you are lodging your own paper tax return, a paper schedule is required.

ATO Online Detailed Instructions

The ATO’s online reference to lump sum arrears is here: Item 24 – Other income (2023) – scroll down the page to the heading “Lump sum payments in arrears” and follow the detailed instructions for completion of a “Schedule of additional information – Item 24”.

Item 24 – Other Income: 2023 – 2022 – 2021 – 2020 – 2019

Online Lodgment With MyTax

For online tax return lodgers using myTax, the app allows lump sum payments in arrears to be entered under “Other Income”.

See also:

Employer lump sum payments 2023

Employer lump sum payments 2022

Employer lump sum payments 2021

Employer lump sum payments 2020

Employer lump sum payments 2019

This page was last modified 2023-05-09