Flood Levy – only applicable for the 2011-2012 year

The Flood Levy is applied to Taxable Incomes with effect from 1 July 2011 and applies until 30 June 2012 only.

In 2013 the Treasurer announced that the Queensland Floods Recovery program for floods which have occurred since 2011 will be undertaken without the need for another flood levy.

For 2011-12 incomes between $50,000 and $100,000 the Levy is 0.5% (i.e. one half of one percent) of the excess over $50,000.

For incomes over $100,000, the Levy is 1%.

How To Calculate The Flood Levy

| Taxable Income> | Flood levy on this income |

| $0 to $50,000 | Nil |

| $50,000 to $100,000 | Half a cent for each $1 over $50,000 |

| Over $100,000 | $250 plus 1 cent for each $1 over $100,000 |

Flood Levy Exemptions

Victims of flood disaster are exempt from the Levy, which includes the Queensland disasters of 2011, and western Queensland and northern NSW floods of 2012.

Qualification for the exemptions arises under one of three possible classes of people who were affected by the declared natural disasters.

Class 1 – You Received an Australian Government Disaster Recovery Payment from Centrelink (note that such payments are tax exempt, and do not need to be included in your tax return).

Class 2 – You were affected by a declared natural disaster (but didn’t necessarily claim a Recovery Payment), and as a result at least one of the following conditions applied in the period 1 July 2010 to 30 June 2012:

- you were unable to gain access to your home for at least 24 hours

- you were stranded in your home for at least 24 hours

- your spouse, child, parent, brother, sister or legal guardian, who was an Australian citizen, died

- you were seriously injured

- your home was destroyed, or sustained major damage

- your home was without electricity, or water, or gas, or sewerage services or another essential service for at least 48 hours

and you were a principal carer of a dependent child under 16 years old who experienced any of the events listed above

or you were at least 16 years old, or receiving a social security payment from Centrelink and you were an Australian resident for social security purposes

Class 3 – New Zealand citizens holding a special category visa who received an ex-gratia payment from Centrelink for a natural disaster that occurred in the period 1 July 2010 to 30 June 2012

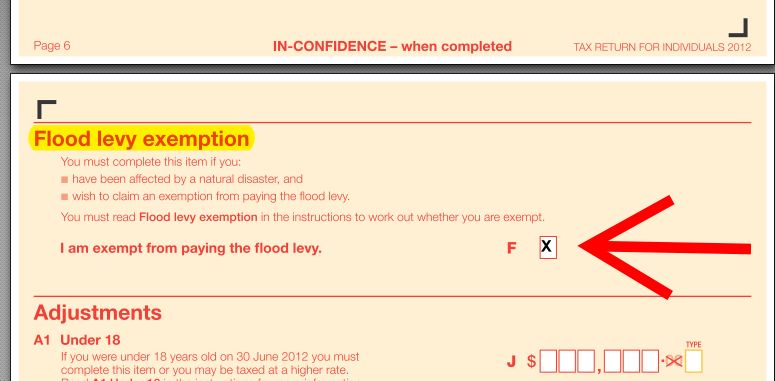

Claiming The Flood Levy Exemption (2012)

If you are eligible to claim the Flood Levy Exemption, make sure that you tell the Tax Office by ticking the box in your 2012 tax return.

This page was last modified 2021-07-06