A negative gearing calculator can help demonstrate why investment decisions should never be driven solely by tax considerations, even though income tax and capital gains taxes may form a significant component of investment performance.

A negative gearing calculator can help demonstrate why investment decisions should never be driven solely by tax considerations, even though income tax and capital gains taxes may form a significant component of investment performance.

This is especially so when an investment is financed by a loan, with the increase in risk that that involves. Hence the importance of measuring the tax and cash flow outcomes of investment decisions.

Despite the offsetting tax benefits, “negative gearing” has never been the automatic road to riches some in the wider investment advice community would have us believe. And with every fluctuation in investment markets, inflation doesn’t so easily hide the mistakes. Sooner or later (sometimes too late) bad decisions are revealed.

Smart investing is all about the balancing of risk and return. When you make an investment, you are guessing the future returns, with a risk of getting it wrong.

Simple spreadsheet negative gearing calculator – cut to the chase

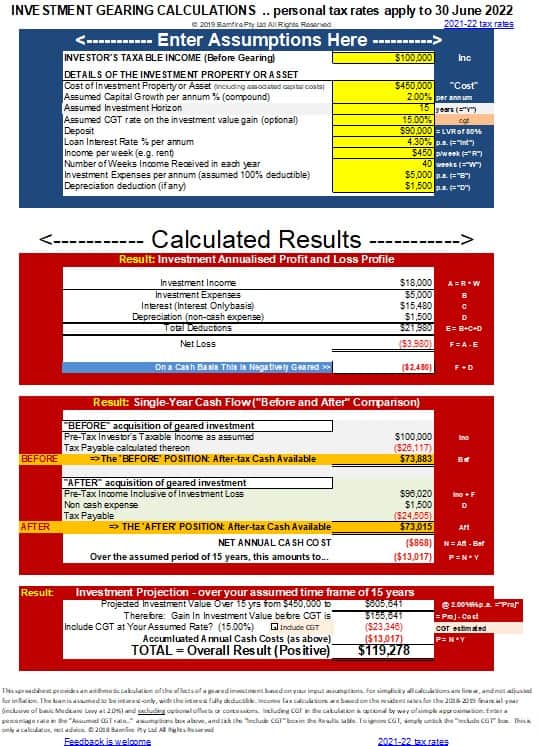

To compare investment proposals which have a loan element, put different sets of assumptions into the negative gearing calculator spreadsheet, to project results. Manipulating risk and return assumptions enables you to find a calculated level of comfort before spending hard-earned dollars on an investment proposal.

So this spreadsheet works as a smart back-of the-envelope decision tool. It’s useful as a fast guide to the financial arithmetic involved in a geared investment decision, where the investment costs are tax deductible.

The spreadsheet is deliberately very simple, so that the cause, effect and projected results can be very clearly understood, without clouding the issue with technical fine tuning, or minute analysis of arcane tax provisions which don’t have a major impact on the outcome.

The spreadsheet can be used to evaluate the effect of any tax-effective leveraged investment, such as shares, property, rental property etc.

Use of the calculator assumes you have a reasonably well-informed idea of income and expense profiles, and prefer a fast-but-good estimate over a slow-but-highly-accurate kind of analysis.

The spreadsheet is basically a single investor, single investment model.

The spreadsheet works on current tax rates (applicable to 30 June 2022) and doesn’t take into account future tax changes or changing inflation levels

The effect of CGT is simplified by entering a single percentage rate assumption; there is no detailed breakdown of potential CGT outcomes. Loan funding is factored on an interest-only basis

Overall benefits? Speed and simplicity. For advisors, it’s a simple one-page colour report which can be handed to a client or filed as a working paper.

This simple Negative Gearing Spreadsheet calculator is a convenient way to assess risk and return, because all the important assumptions can be entered quickly. Loan funding – being one of the most important risk factors – can be easily manipulated to estimate outcomes – positive, neutral or negative.

The spreadsheet is built for MS Excel versions 1997-2003 or later.

Get the spreadsheet Negative Gearing Calculator ($5.97) here:

Immediate download: On completion of your payment your browser will be sent to a download link, and an email containing the link will be sent to your payment address. Any problems please contact us here for prompt attention.

This page was last modified 2019-07-04