Update 25 April 2018: The proposed medicare levy increase to 2.5% has been abandoned.

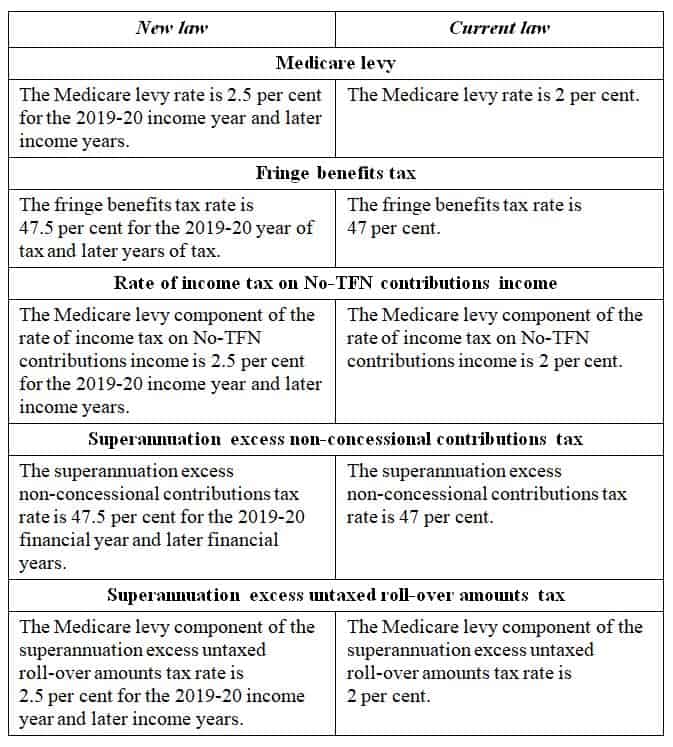

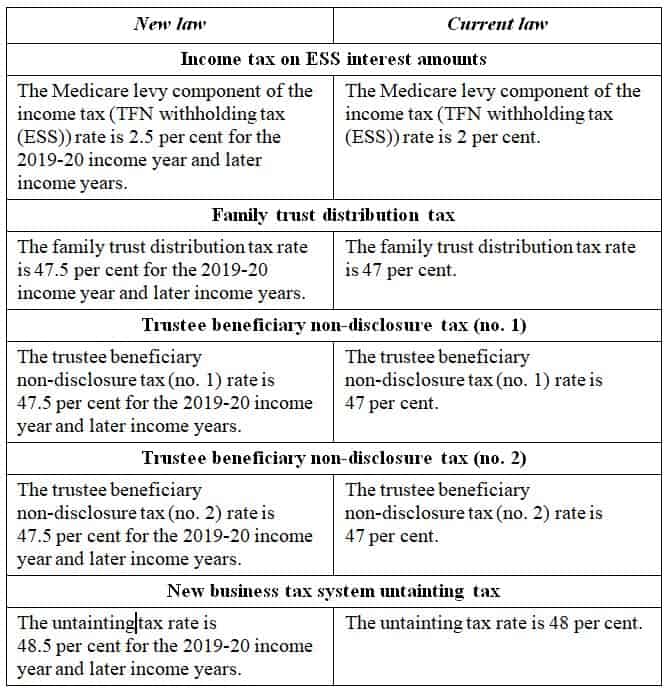

A package of 11 bills to fund the Commonwealth’s contribution to the National Disability Insurance Scheme, by increasing the Medicare levy from 2 per cent to 2.5 per cent of a person’s taxable income.

Under the Bills, the rate changes would apply from 1 July 2019 (FBT rate from 1 April 2019) for the 2019-20 year and following.

Bills in the package

- Medicare levy amendment (national disability insurance scheme funding) Bill 2017

- Fringe Benefits Tax Amendment (National Disability Insurance Scheme Funding) Bill 2017

- Income Tax Rates Amendment (National Disability Insurance Scheme Funding) Bill 2017

- Superannuation (Excess Non-concessional Contributions Tax) Amendment (National Disability Insurance Scheme Funding) Bill 2017

- Superannuation (Excess Untaxed Roll-over Amounts Tax) Amendment (National Disability Insurance Scheme Funding) Bill 2017

- Income Tax (TFN Withholding Tax (ESS)) Amendment (National Disability Insurance Scheme Funding) Bill 2017

- Family Trust Distribution Tax (Primary Liability) Amendment (National Disability Insurance Scheme Funding) Bill 2017

- Taxation (Trustee Beneficiary Non-disclosure Tax) (No. 1) Amendment (National Disability Insurance Scheme Funding) Bill 2017

- Taxation (Trustee Beneficiary Non-disclosure Tax) (No. 2) Amendment (National Disability Insurance Scheme Funding) Bill 2017

- Treasury Laws Amendment (Untainting Tax) (National Disability Insurance Scheme Funding) Bill 2017

- Nation-building funds repeal (National Disability Insurance scheme funding) Bill 2017

Comparison of key features of new law and current law

.

This page was last modified 2018-04-25