After registering with an ABN and for GST, Uber drivers then need to lodge a business activity statement (BAS) on a regular basis.

The normal BAS statement lodgment cycle is quarterly.

Returns are officially required to be lodged within 28 days of the end of the quarter (allowing for public holidays), but there is an ongoing minimum 2-week extension allowed for electronic lodgers for the June, September, and March quarters.

The December quarter BAS return lodgement date is generally extended to the end of February.

Registered Tax or BAS Agents also have an extension of time to lodge BAS returns for their clients usually an additional 4 weeks after the statutory due date, apart from the December (2nd quarter) which already has an 8 week lodgement period available.

Note that anyone providing BAS services must be registered by the Tax Practitioners Board which also maintains a public register of Agents and accepts complaints.

Current BAS statement lodgement dates are listed here.

BAS reminders

The Tax Office normally contacts the business (usually 2 to 3 weeks) before the end of the period, by sending out a paper BAS form for completion, or by notifying that the electronic version of the form is available.

The preferred lodgement method can be nominated on registration setup, but the Tax Office is strongly encouraging electronic lodgement. Once an electronic lodgment has been made, no further paper forms will be issued for future returns.

It is not possible to download a blank BAS form, because each form is individually pre-filled with you identifying details. This applies to both paper and electronic forms.

Filling out a BAS statement

The purpose of a BAS statement is to summarise and calculate money owed to the Tax Office (or refundable in some instances).

In the case GST, this means calculating the GST collected on the full fare income, and deducting from that total all the GST included in deductible expenses.

Accuracy in calculating the GST is important, because penalties apply for getting it wrong, especially if the Tax Office doesn’t receive the full amount due. There is however some tolerance for small errors which can be corrected on a future return without penalty – see here.

The Tax Office is very active matching data between entities to capture missing or incorrect income reporting. Uber drivers are specifically targeted under the data-matching programs which have the purposes of detecting undeclared income and incorrect expense claims.

Calculating GST

In many cases, identifying the GST component of income or expenditure is simple arithmetic – the GST will be exactly 1/11th of the transaction amount. Uber drivers’ GST income can normally be readily identified from Uber statements, and so the GST component easily determined.

On the expenditure side, the law (with some exceptions) requires that you hold a Tax Invoice or equivalent documents in support of GST amounts claimed for every amount over $82.50. A Tax Invoice is the name given to an invoice document which identifies the amount of GST paid.

Uber service fees

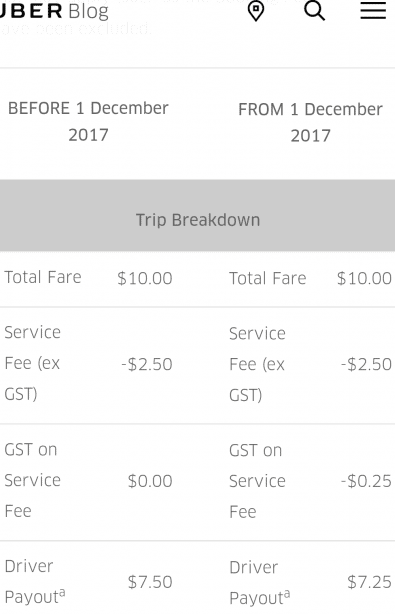

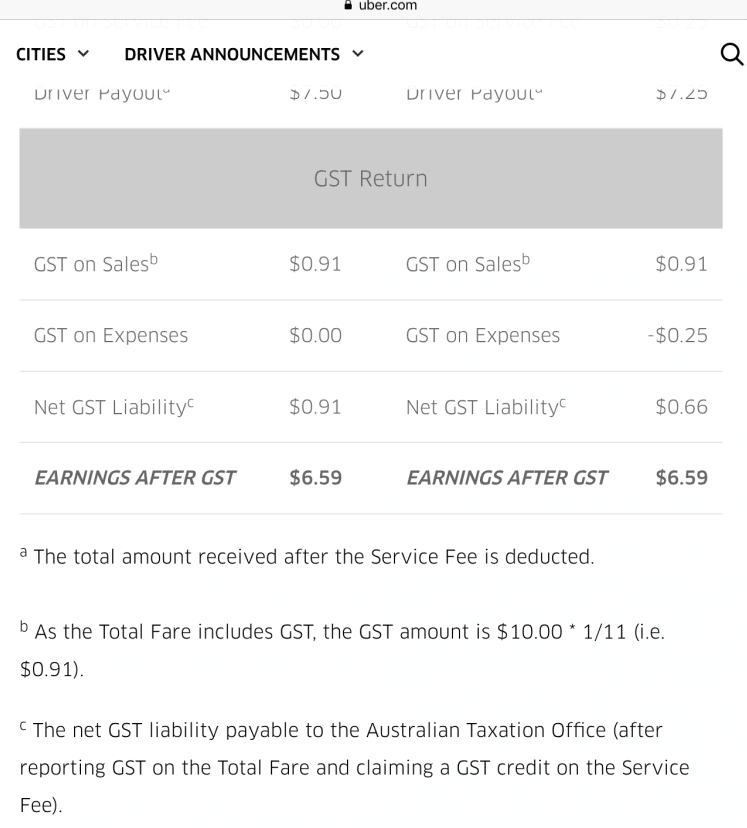

All service fees paid to Uber will have the standard 1/11th GST included (from 1 Dec 2017), thus claimable by the driver as a GST credit.

This is an important claim because Uber’s fees were increased from 1 Dec 2017 to add the GST component. The reduced driver payout and the GST credit on fees paid offset each other, and the driver is therefore no worse off – as the following screenshot calculations confirm:

There can be a number of reasons why the GST component of an expense may not be 1/11th of the amount paid. They include:

- a GST credit can’t be claimed for any expense not directly attributable to the business (this generally means it must also be tax deductible, or claimable capital expenditure)

- a supplier not registered for GST does not include GST in the supply price

- some expenses are not subject to GST – for example bank interest, bank fees, wages and super, donations

- some expenses are only partly subject to GST – for example vehicle registration

- some expenses are only partly business use – for example vehicle running costs

Vehicle insurance settlements and corresponding repair payments normally include GST at the full 10% rate which can be claimed or offset, depending on how the repair bill is settled – either personally or by the insurer. If the insurer pays the repairer directly and in full, however, there is nothing out of pocket and no claim to be made by the insured person (driver). For a longer description of the various circumstances see here.

Payment or refund of the GST difference

The calculated GST difference, if positive, must be paid to the Tax Office by the due date of the return. The payment can be made by BPay for the details are provided on the form itself (both electronic and paper).

If a refund is due (because claimed GST expenditure is more than the GST income) the Tax Office will credit the amount due to your nominated bank account. The bank account is provided to the Tax Office on registering, and can be updated online or by phone.

See further:

This page was last modified 2017-12-12