To comply with the tax laws, certain information must be included in tax invoices.

Registered for GST:

As a vendor registered for GST you usually will need to issue a “Tax Invoice” which shows the amount of GST included or (depending on the amount) at least the basis of calculation.

Not Registered for GST:

If not registered for GST, or not required to be, the document description will simply be “Invoice”, and should contain a statement to the effect that no GST has been charged.

Tax Invoice

A valid tax invoice (or valid substitute) is required by purchasers to support their legal claim to a GST credit (“input tax credit”). A tax invoice must be issued for any taxable sales of more than $82.50 (including GST), where the purchaser requests it.

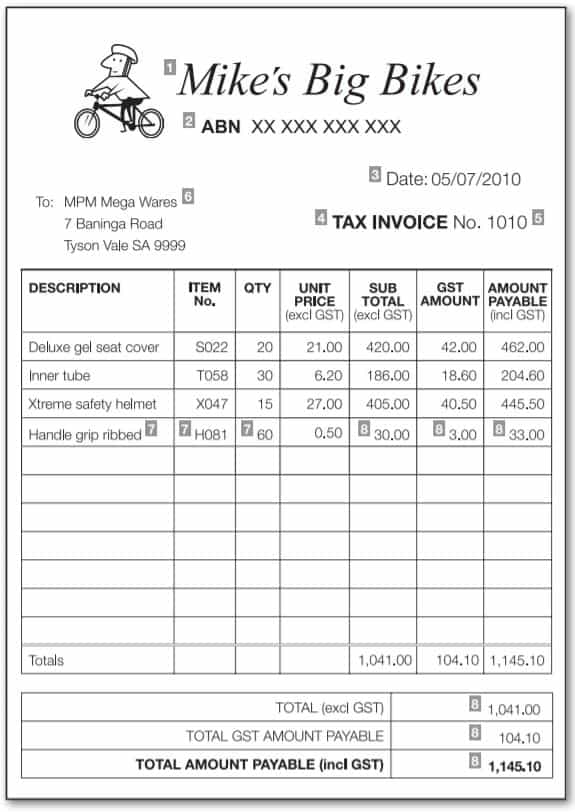

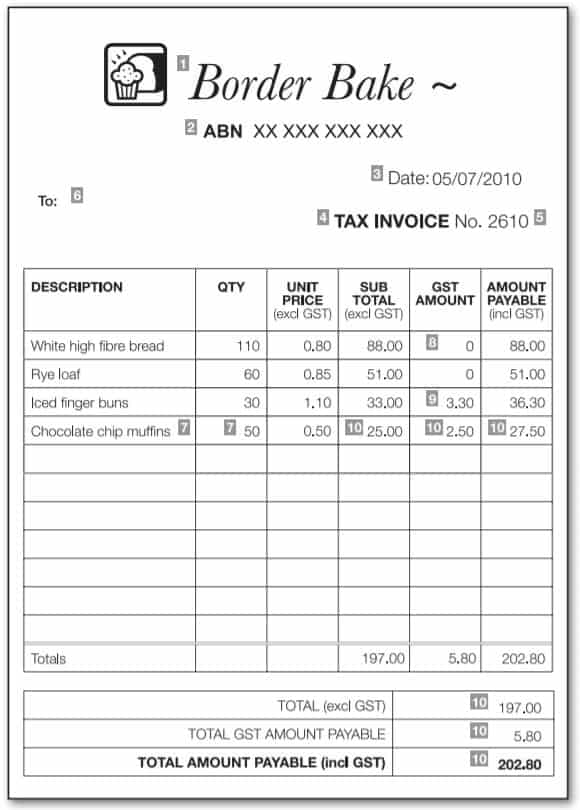

The requirements include:

- vendor’s name and ABN

- description and quantity of items/service

- the extent to which each sale is a taxable sale – separately or, if the GST to be paid is exactly one-eleventh of the total price, as a statement such as ‘total price includes GST’

- date of issue

- amount of GST

- if a recipient-issued document, it is clear that the GST is payable by the supplier

- it is clear the document is a tax invoice or a recipient-created tax invoice

- Invoices for $1,000 or more also need to show the buyer’s identity or ABN

ATO Fact Sheet – tax invoice standards

In addition to the legal requirements, there are some common-sense requirements of an invoice which the Tax Office sets out as “voluntary standards”.

Samples of recommended invoice designs (see images below) are included in this fact sheet (pdf): Nat 11675

Further information

- ATO Ruling GSTR 2013/1 Goods and services tax: tax invoices

- Tax invoices generally and claiming credits – see Tax Invoices

- When the receiver of goods or services creates a Tax Invoice – see Recipient Created Tax Invoice

- Practice Statement Law Administration PS LA 2004/11 Treating a document as a tax invoice or adjustment note. ATO guidance for the exercise of discretion to treat a document as valid when the document does not meet the specific requirements for a valid tax invoice or adjustment note.

This page was last modified 2021-06-09