Example BAS forms provide a guide for classifying your business transactions, and how to (or whether to) report transactions.

BAS forms are personalised by the Tax Office to each business with pre-filled information, and so blank forms for lodgment are not normally provided.

BAS returns (or electronic equivalents) are made available by the Tax Office several weeks prior to the lodgment date.

Simplified BAS returns details

BAS returns for small businesses are simpler, with less detail being required to fill in the BAS return form.

For small businesses (GST turnover of less than $10 million), only the following GST information will be required to be reported:

GST on sales (1A)

GST on purchases (1B)

Total sales (G1)

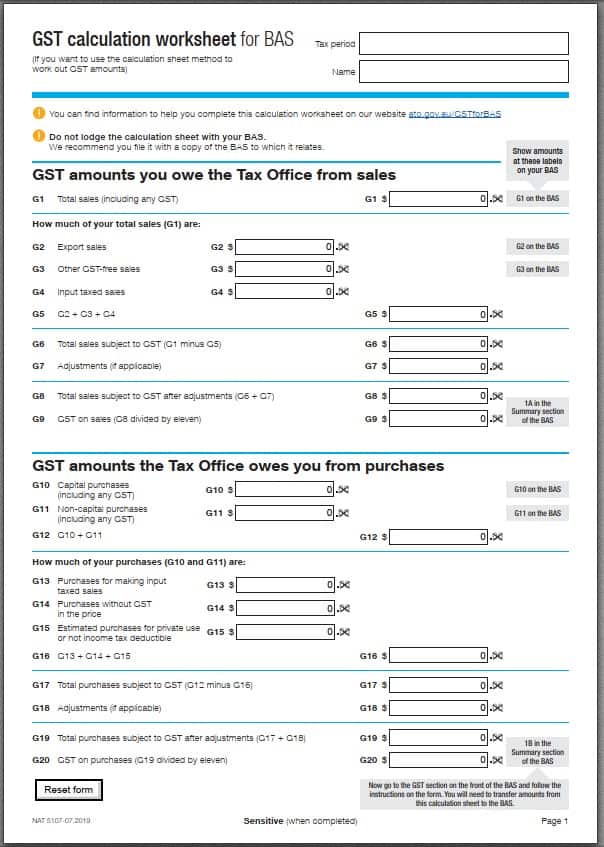

Filled Example GST Calculation For BAS Worksheet

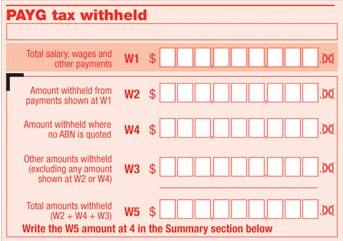

PAYG withholding labels guide

For a checklist guide as to what is included in “W1 – Total salary, wages and other payments” as well as labels W2, W3, W4 and W5 on the activity statement see the ATO’s article here.

BAS Statement guides for other transactions

To help determine how transactions should be treated in your records and in the BAS statement return, examples of transactions are shown here:

Example Activity Statement Quarterly Form

Example activity statement form – front and rear

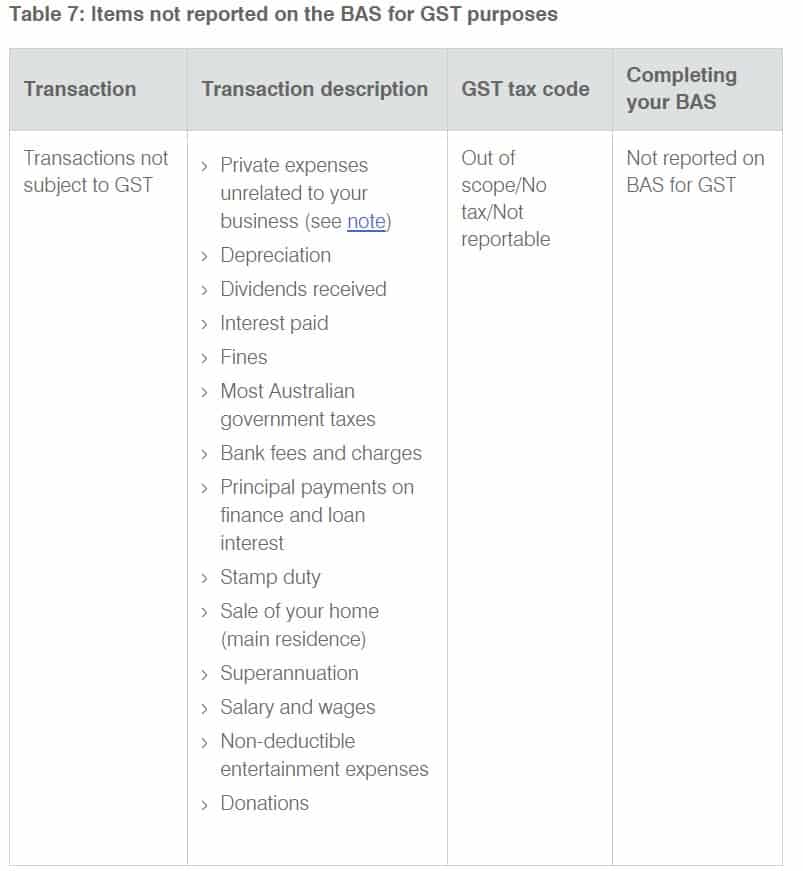

Items Not Reportable For GST Purposes

What doesn’t have to be reported for GST purposes?

Some items of income or expense do not need to be reported on the BAS form for GST purposes. That is because they are specifically excluded as private, non-deductible or in a category such as wages and superannuation.

Transactions may only be partially non-reportable.

Items which do not need to be reported are not shown on the BAS form as GST items, however wages and associated withholdings, and income tax instalments have dedicated labels for reporting purposes.

Typically non-reportable items are identified in accounting software as “no tax”, “non-taxable”, “NT” or similar.

Source: ATO – List of items not reportable for GST purposes.

Non-taxable transactions should also be distinguished from items which are reportable but GST free, and transactions which are input taxed, each of which has separate disclosure labels on the BAS form.

Business Activity Statement Labels Explained

The Tax Office’s bookkeeping guide describing all of the reporting categories is here. The information contains explanations for all the labels on a BAS statement including:

- G1 Total sales

- 1A GST on sales – for goods and services, assets and property

- GST free sales

- Input taxed sales

- 1B GST on purchases

- 7D Fuel tax credit

- No GST, not reportable

- Motor vehicle purchase

Download fillable BAS worksheet

To download a fillable BAS worksheet in PDF format, click following link:

Registration for electronic lodgment of BAS forms

To register for electronic lodgment of BAS forms – start here BAS lodgment

GST Calculations – calculator

How to vary the amount you pay on PAYG instalments

For instalment variations generally, see Tax Office information here.

For variations based on Covid circumstances see here.

BAS Statements additional info links

- GSTR 2000/26 Goods and services tax: corporate card statements – entitlement to an input tax credit without a tax invoice

- GST/BAS registration

- Simpler BAS GST bookkeeping guide

- example annual GST return

This page was last modified 2023-06-02