The BAS or IAS return Standard due dates for 2023-24 for Small Businesses lodging quarterly typically allow 28 days plus 2 weeks from period-end if lodging online, except for the December quarter where the lodgment deadline is the end of February. Lodging via an agent will normally provide a further 2 weeks.

BAS Due Dates 2023-24 Quarterly Small Business Returns

| 2023-24 BAS quarterly return periods | Due Date before |

| 4th Quarter: (2022-23) 1 April to 30 June 2023 | Standard due date 28 July 2023 (+2 weeks = 11 Aug 2023) Agent: 25 August 2023 |

| 1st Quarter: (2023-24) 1 July to 30 Sept 2023 | Standard due date 28 Oct 2023 (+ 2 weeks = 11 Nov 2023) Agent: 25 November 2023 |

| 2nd Quarter: (2023-24) 1 October to 31 Dec 2023 | 28 February 2024 |

| 3rd Quarter: (2023-24) 1 January to 31 March 2024 | Standard due date 28 April 2024 (+ 2 weeks = 12 May 2024) Agent: 26 May 2024 |

| 4th Quarter: (2023-24) 1 April to 30 June 2024 | Standard due date 28 July 2024 (+ 2 weeks = 11 Aug 2024) Agent: 25 August 2024 (to be confirmed) |

ATO Bas Statement Interest Free Payment Plan

The Tax Office has arrangements for small businesses to pay off activity statement amounts without interest over a period of 12 months if certain qualifying criteria are met.

This is in addition to automatic arrangements for payment plans which can be actioned for debts under $100,000.

The stated criteria for an interest-free arrangement are:

- annual turnover of less than $2 million

- activity statement debt of $50,000 or less, overdue for 12 months or less

- no more than one payment plan default within the last 12 months

- no outstanding activity statement lodgments

- cannot obtain finance (such as a loan) through normal business channels

- can demonstrate ongoing viability.

Payment plans can be setup or managed by contacting the Tax Office online or by phone (or via a tax agent).

The contact links are on this page.

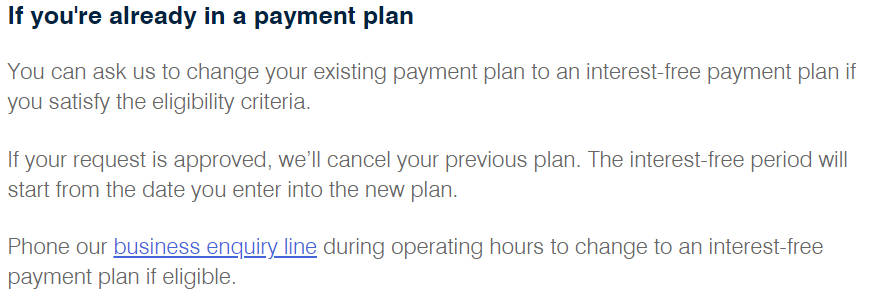

Then to change a plan to interest-free, the ATO advise you to contact their business enquiry line (linked below):

At the time of writing, the business enquiry line published on the page linked above is 13 28 66 between the hours of 8am to 6pm (AEST) Monday to Friday.

BAS Due Dates 2022-23 Quarterly Small Business Returns

| 2022-23 BAS quarterly return periods | Due Date before |

| 4th Quarter: (2021-22) 1 April to 30 June 2022 | Standard due date 28 July 2022 (+2 weeks = 11 Aug 2022) Agent: 25 August 2022 |

| 1st Quarter: (2022-23) 1 July to 30 Sept 2022 | Standard due date 28 Oct 2022 (+ 2 weeks = 11 Nov 2022) Agent: 25 November 2022 |

| 2nd Quarter: (2022-23) 1 October to 31 Dec 2022 | 28 February 2023 |

| 3rd Quarter: (2022-23) 1 January to 31 March 2023 | Standard due date 28 April 2023 (+ 2 weeks = 12 May 2023) Agent: 26 May 2023 |

| 4th Quarter: (2022-23) 1 April to 30 June 2023 | Standard due date 28 July 2023 (+ 2 weeks = 11 Aug 2023) Agent: 25 August 2023 |

BAS Due Dates 2021-22 Quarterly Small Business Returns

| 2021-22 BAS quarterly return periods | Due Date before |

| 4th Quarter: (2020-21) 1 April to 30 June 2021 | Standard due date 28 July 2021 (+2 weeks = 11 Aug 2021) Agent: 25 August 2021 |

| 1st Quarter: (2021-22) 1 July to 30 Sept 2021 | Standard due date 28 Oct 2021 (+ 2 weeks = 11 Nov 2021) Agent: 25 November 2021 |

| 2nd Quarter: (2021-22) 1 October to 31 Dec 2021 | 28 February 2022 |

| 3rd Quarter: (2021-22) 1 January to 31 March 2022 | Standard due date 28 April 2022 (+ 2 weeks = 12 May 2022) Agent: 26 May 2022 |

| 4th Quarter: (2021-22) 1 April to 30 June 2022 | Standard due date 28 July 2022 (+ 2 weeks = 11 Aug 2022) Agent: 25 August 2022 |

The actual due dates for each of your lodgment periods are as advised to you by the Tax Office in the Business Portal, or on the paper form if you still receive it.

The Tax Office encourages electronic lodgment and offers an a conditional 2-week lodgment extension (beyond the Standard due date) for quarterly non-large business electronic self-preparing lodgers.

Electronic lodgements of BAS returns

The Tax Office is pushing hard for some form of electronic lodgement as the default method, instead of paper returns. Once an electronic lodgment has been made by an entity, the Tax Office will discontinue any further issue of paper forms for completion of future returns.

(Note: For information regarding tax return lodgement dates see tax return lodgment dates)

BAS Statement Return Lodgement Dates (Quarterly)

Full payment is also normally due on the normal lodgment date, unless the Tax Office has agreed to a specific arrangement.

BAS Form Generation Dates

Pre-filled forms are usually generated several weeks in advance of the period-end date, and electronic lodgers notified in the portal and by email. Paper forms distributed via snail mail necessarily take a little longer. Click this link to see the BAS form generation dates published by the Tax Office.

Quarterly due dates (other than for the December period due in February) ending on the 28th of the month are generally eligible for an automatic 2-week extension if lodged using online services or via a registered agent – see full eligibility requirements here.

Thus for the June 2020 quarter BAS statement the standard due date of 28 July 2020 is automatically extended until 11 August 2020.

Source: ato.gov.au * if due date falls on a weekend, automatically extended to Monday

Lodgement Dates – the general rules

The general position with regard to due dates is that from the end of the respective periods:

- quarterly returns must be lodged within 28 days (section 31.8) , and

- monthly returns must be lodged within 21 days (section 31.10)

* Quarterly returns with an original due date of 28th lodged electronically generally qualify for an automatic 2 week extension of time.

Eligibility conditions do not include large businesses and monthly lodgers – with the exception of small businesses lodging monthly with a tax agent – the December due date of 21 January is extended to 21 February.

Penalties are normally automatically calculated for late lodgment.

In general, where the due date falls on a weekend or public holiday, it is automatically moved to the next business day.

See Lodgment and payment dates on weekends or public holidays

Withdrawal of paper BAS returns

From 1 July 2014, once an electronic statement has been lodged through any channel, the Tax Office will no longer issue paper BAS forms. Larger businesses (as defined by a turnover test) must lodge electronically.

Large companies –reform to timing of tax instalments

From 1 January 2014 tax payments arrangements for large companies changed, with the commencement of monthly payments, instead of quarterly. See Larger businesses turnover test and further information here.

Amending BAS returns – correcting errors

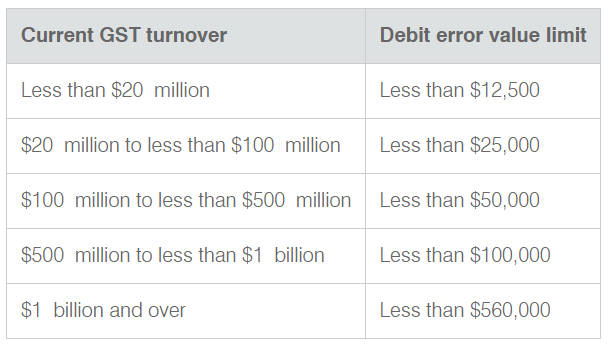

GST and fuel tax credits errors can be corrected without penalty on either a current or future BAS return (your choice), subject to time and value limits, and provided you are not already subject to compliance action from the Tax Office.

There are two types of GST errors: credit errors and debit errors. Credit errors can be corrected on a later BAS within time limits.

Debit errors can be corrected on a later BAS within certain time and value limits, and generally only if compliance activity by the Tax Office is not already under way.

The time limit is 4 years.

To correct a GST error, the amount must be included at boxes 1A or 1B on the later BAS.

Records and notes must be kept to explain the correction.

If the correction falls outside the time or value limits, then the BAS return for the period of the correction must be revised, potential leading to penalties plus interest.

See a full explanation and requirements from the Tax Office here: Correcting GST errors.

News (from 1 July 2018): Small businesses automatic penalty relief – once in 3 years – for entities with turnover under $10 million. “Inadvertent” errors discovered by the Tax Office during an audit, will not attract a penalty. This concession cannot be applied for; The Tax Office will automatically grant relief during and audit, not more than once every three years. See details here.

Further information:

BAS Due dates in earlier years

BAS Due Dates 2020-21

| 2020-21 BAS quarterly return periods | Due Date before |

| 4th Quarter: (2019-20) 1 April to 30 June 2020 | Standard due date 28 July 2020 Agent: 25 August 2020 |

| 1st Quarter: 1 July to 30 Sept 2020 | Standard due date 28 Oct 2020 Agent: 25 November 2020 |

| 2nd Quarter: 1 October to 31 Dec 2020 | 28 February 2021 |

| 3rd Quarter: 1 January to 31 March 2021 | Standard due date 28 April 2021 + 2 weeks = 12 May 2021 Agent: 26 May 2021 |

| 4th Quarter: 1 April to 30 June 2021 | Standard due date 28 July 2020 Agent: 25 August 2021 |

BAS Due Dates Year 2019-20

| 2019-20 BAS quarterly return periods | Due Date before |

| 4th Quarter: (2018-19) 1 April to 30 June 2019 | Standard due date 30 July 2019* Agent: 25 August 2019 |

| 1st Quarter: 1 July to 30 Sept 2019 | Standard due date 28 Oct 2019 Agent: 25 November 2019 |

| 2nd Quarter: 1 October to 31 Dec 2019 | 28 February 2019 |

| 3rd Quarter: 1 January to 31 March 2020 | Standard due date 28 April 2020 + 2 weeks = 12 May 2020 Agent: 26 May 2020 |

| 4th Quarter (2019-20): 1 April to 30 June 2020 | Standard due date 28 July 2020 Agent: 25 August 2020 |

Bas Due Dates Year 2018-19

| Period | Due Date |

| 4th Quarter: (2017-18) 1 April to 30 June 2018 | Standard due date 30 July 2018* agent ELS: 25 August 2018 |

| 1st Quarter: 1 July to 30 Sept 2018 | Standard due date 29 Oct 2018* agent ELS: 25 November 2018 |

| 2nd Quarter: 1 October to 31 Dec 2018 | 28 February 2019 |

| 3rd Quarter: 1 January to 31 March 2019 | Standard due date 29 April 2019* agent ELS: 26 May 2019 |

| 4th Quarter (2018-19): 1 April to 30 June 2019 | Standard due date 28 July 2019 agent ELS: 25 August 2019 |

BAS Due Dates Year 2017-18

| Period | Due Date |

| 4th Quarter: 1 April to 30 June 2018 | Standard due date 28 July 2018 agent ELS: 25 August 2018 |

| 3rd Quarter: 1 January to 31 March 2018 | Standard due date 28 April 2018 agent ELS: 26 May 2018 |

| 2nd Quarter: 1 October to 31 Dec 2017 | 28 February 2018 |

| 1st Quarter: 1 July to 30 Sept 2017 | Standard due date 28 October 2017 agent ELS: 25 November 2017 |

| 4th Quarter (2016-17): 1 April to 30 June 2017 | Standard due date 28 July 2017 agent ELS: 25 August 2017 |

BAS Due Dates Year 2016-17

| Period | Due Date |

| 4th Quarter: 1 April to 30 June 2017 | Standard due date 28 July 2017 * agent ELS: 25 August 2017 |

| 3rd Quarter: 1 January to 31 March 2017 | Standard due date 28 April 2017 * agent ELS: 26 May 2017 |

| 2nd Quarter: 1 October to 31 Dec 2016 | 28 February 2017 |

| 1st Quarter: 1 July to 30 Sept 2016 | Standard due date 28 October 2016 * agent ELS: 25 November 2016 |

BAS Due Dates Year 2015-16

| Period | Due Date |

| 4th Quarter: 1 April to 30 June 2016 | Standard due date 28 July 2016 * agent ELS: 25 August 2016 |

| 3rd Quarter: 1 January to 31 March 2016 | Standard due date 28 April 2016 agent ELS: 26 May 2016 |

| 2nd Quarter: 1 October to 31 Dec 2015 | 28 February 2016 |

| 1st Quarter: 1 July to 30 Sept 2015 | Standard due date 28 October 2015 agent ELS: 25 November 2015 |

BAS Due Dates Year 2014-15

| Period | Due Date |

| 4th Quarter: 1 April to 30 June 2014 | Standard due date 28 July 2014 Electronic auto extension 11 August 2014* agent ELS: 25 Aug 2014 |

| 1st Quarter: 1 July to 30 Sept 2014 | Standard due date 28 October 2014 * agent ELS: 25 November 2014 |

| 2nd Quarter: 1 October to 31 Dec 2014 | 28 February 2015 |

| 3rd Quarter: 1 January to 31 March 2015 | Standard due date 28 April 2015 * agent ELS: 26 May 2015 |

| 4th Quarter: 1 April to 30 June 2015 | Standard due date 28 July 2015 * agent ELS: 25 August 2015 |

BAS Due Dates Year 2013-14

| Period | Due Date |

| 4th Quarter: 1 April to 30 June 2013 | 28 July 2013 agent ELS: 25 Aug 2013 |

| 1st Quarter: 1 July to 30 September 2013 | 28 Oct 2013 * agent ELS: 25 Nov 2013 |

| 2nd Quarter: 1 October to 31 Dec 2013 | 28 Feb 2014 |

| 3rd Quarter: 1 January to 31 March 2014 | 28 Apr 2014 * agent ELS: 26 May 2014 |

| 4th Quarter: 1 April to 30 June 2014 | Standard due date 28 July 2014 Electronic auto extension 11 August 2014* agent ELS: 25 Aug 2014 |

BAS Due Dates Year 2012-13

| Period | Due Date |

| 4th Quarter: 1 April to 30 June 2012 | 28 July 2012 electronic: 11 Aug 2013 |

| 1st Quarter: 1 July to 30 September 2012 | 28 Oct 2012 electronic: 11 Nov 2013 |

| 2nd Quarter: 1 October to 31 December 2012 | 28 Feb 2013 |

| 3rd Quarter: 1 January to 31 March 2013 | 28 Apr 2013 electronic: 12 May 2013 |

| 4th Quarter: 1 April to 30 June 2013 | 28 July 2013 agent ELS: 25 Aug 2013 |

This page was last modified 2023-10-17