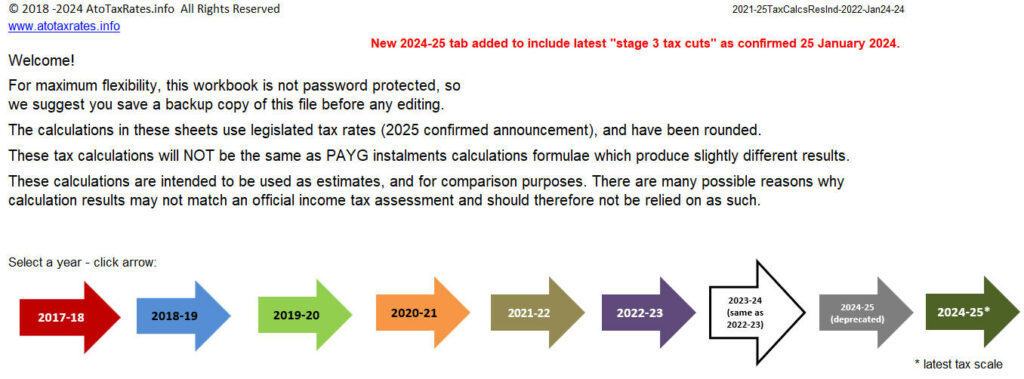

This downloadable Excel tax calculator has been updated for the 2021-22 and later years 2022-23, 2022-24 and 2024-25 and includes the March 2022 Budget increase of $420 to the Lower and Middle Income Tax Offset for the 2021-22 year.

Stage 3 Tax Cuts Adjusted

25 January 2024

The government has approved amendments to reduce the benefit of the original stage tax 3 cuts for higher income earners, and improve the tax scale for lower income earners.

The proposed changes are applicable from 1 July 2024.

More information on the changes is available here.

The Excel calculator downloadable below is being updated for the amended stage 3 tax cuts tax scales and will be available later today.

The current version of the Excel spreadsheet (xlsx) has tabs for tax years 2018 to 2024-25.

The calculator spreadsheet is a multitab MS Excel xlsx file of approx 110kb.

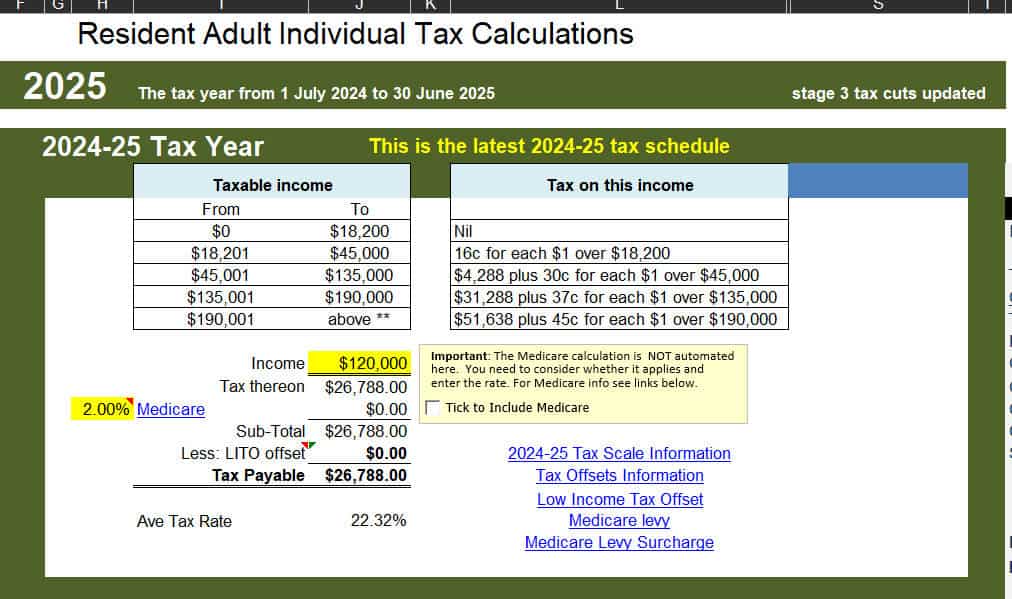

The tax rates used are the official tax rates as legislated by parliament and published by the Tax Office up to the year 2024-25.

As things stand, those rates will be applicable for the 2025-26 year and beyond.

However, please bear in mind that future tax rates can be changed at any time according to government policy.

Useful as a planning tool, this spreadsheet tax calculator provides current adult resident tax rate calculations, with LITO, LMITO, manual medicare selectors and a scratch pad area where you can review the results with adjustments and after-tax calculations.

This simple-to-use calculator has been downloaded by Australian taxpayers more than 50,000 times in the past 2 years.

This calculator enables the calculation of income tax plus Medicare Levy and LITO/LMITO for taxable income on an annual basis. (For periodic income payments, there is a calculator for tax instalment PAYG purposes here.)

[Update: Jan 2024] Tax calculations in the calculator have been updated to include the Stage 3 Tax Cuts tax scale which was confirmed by the government in January 2024 and subsequently enacted into law.

Get the calculator

The calculator is available for $15 here, but if you jump on our mailing list now you can get it for free.

You will also get free updates whenever the calculator is updated, and a nudge on important changes as they happen.

Join our valued subscriber community now! Unsubscribe any time.

Your privacy is respected and assured.

This page was last modified 2024-04-24